Navigating the labyrinth of senior health insurance? Yeah, it can feel like chasing a rabbit down a never-ending hole. You’ve got a buffet of options—each with its own mix of promises and pitfalls. It’s essential, no, crucial, to get a grip on these plans’ fine print and what-not.

Insurance 2ALL gets it—we get it. Snagging the ideal senior health plan means you’ve got to roll up your sleeves and dig deep into unique (and often personal) needs and situations.

This guide? It’s your compass. We’ll walk you through the maze of Medicare options, key decision points, and the perks of additional coverage—all to make sure you’re not just rolling the dice on your healthcare future.

Medicare Explained: Your Options Unveiled

Original Medicare: The Foundation

Let’s break this down-Original Medicare is where it all begins for senior health coverage. It’s the unfancy duo of Part A (hospital insurance) and Part B (medical insurance). Part A? Free as a bird if you’ve been paying those Medicare taxes for a decade. Part B? That one costs ya… in 2025, the going rate is $185.00 per month-a $10.30 hop from 2024’s price tag of $174.70.

Covering about 80% of your healthcare costs, Original Medicare leaves you picking up the tab for the remaining 20%. And those expenses can balloon fast (no joke), especially if you’re dealing with chronic issues or hopping in for care more than you’d like.

Medicare Advantage: Comprehensive Coverage

Now, Medicare Advantage (Part C) is your all-in-one package deal. Think of it as bundling all the things-Part A, Part B, and usually Part D (that’s your prescription drugs)-in one shiny package, courtesy of private insurers with Medicare’s blessing. These plans often tack on extras like dental, vision, and hearing benefits.

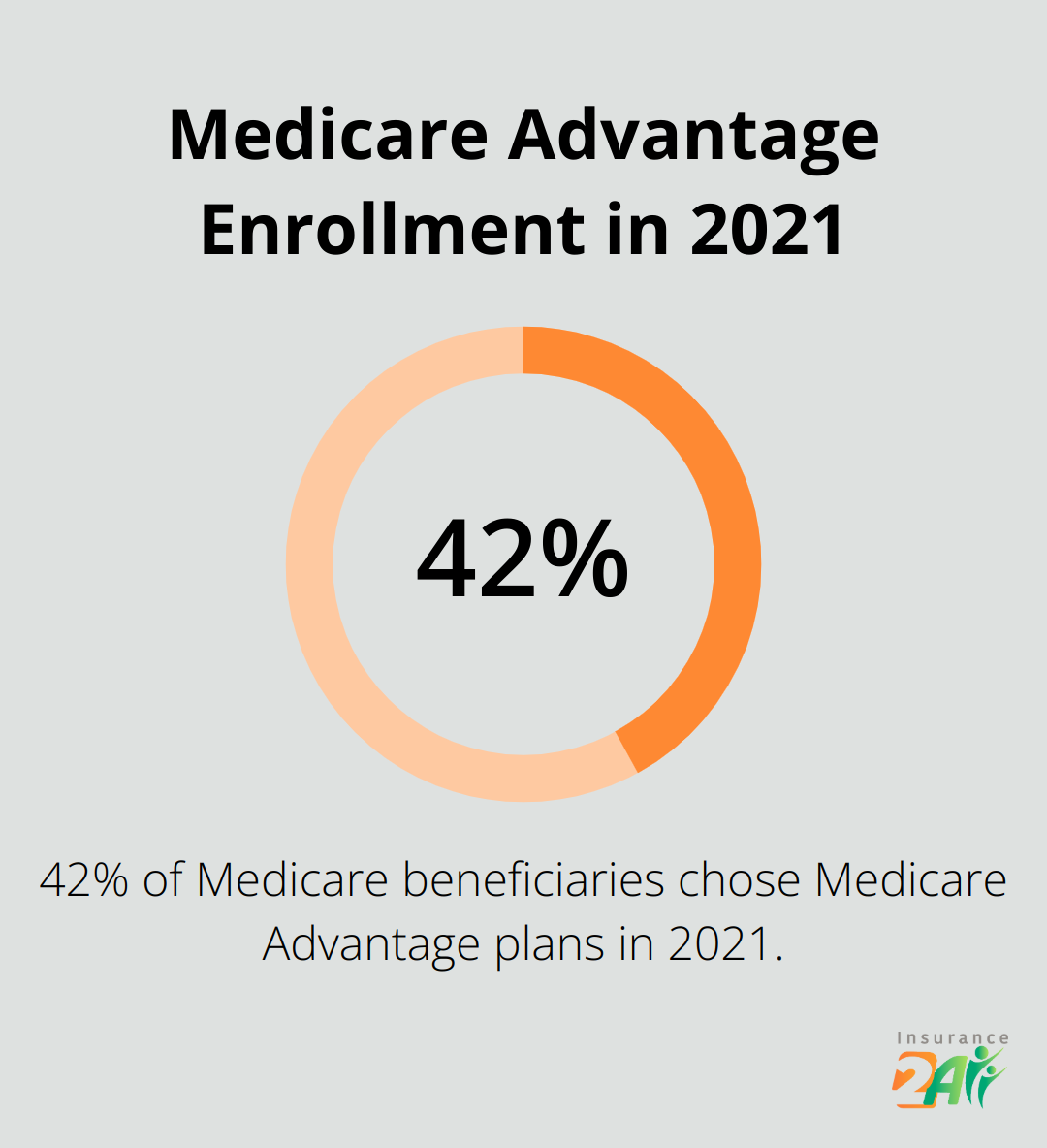

In 2021, the Kaiser Family Foundation noted a cool 42% of Medicare folks jumped on the Medicare Advantage bandwagon. And you better believe that number’s only climbing.

Medigap: Bridging the Gaps

Enter Medigap-your personal assistant in tackling the out-of-pocket hurdles Original Medicare leaves behind. There are 10 standardized Medigap plans to choose from, each with its own jazzed-up level of coverage. The fan-favorite? Plan G. Covers everything except that pesky Part B deductible.

Sure, Medigap plans don’t come cheap-expect to shell out between $150 to $200 a month. But for seniors practically living at the doc’s office? Major savings.

Prescription Drug Coverage: Essential Protection

Prescription medications ain’t getting any cheaper, which makes Medicare Part D a must-have. Whether you go for a standalone plan or slap it onto a Medicare Advantage plan, getting Part D coverage is key.

Jump on Part D as soon as you qualify, even if you’re not on any meds. Delay and you’ll get hit with a late enrollment penalty-a 1% hike on your premium for every uncovered month you sat out.

Understanding these Medicare options is your playbook for making the smart call on your health coverage. Next up: weigh the important stuff that’ll point you to the plan that fits your life like a glove.

Key Factors to Consider When Choosing Senior Health Insurance

Picking the senior health insurance plan that’s truly your jam? It’s kind of like piecing together an epic puzzle-tangled, but hey, it’s got to make sense for you. Here’s the map to steer you through this labyrinth.

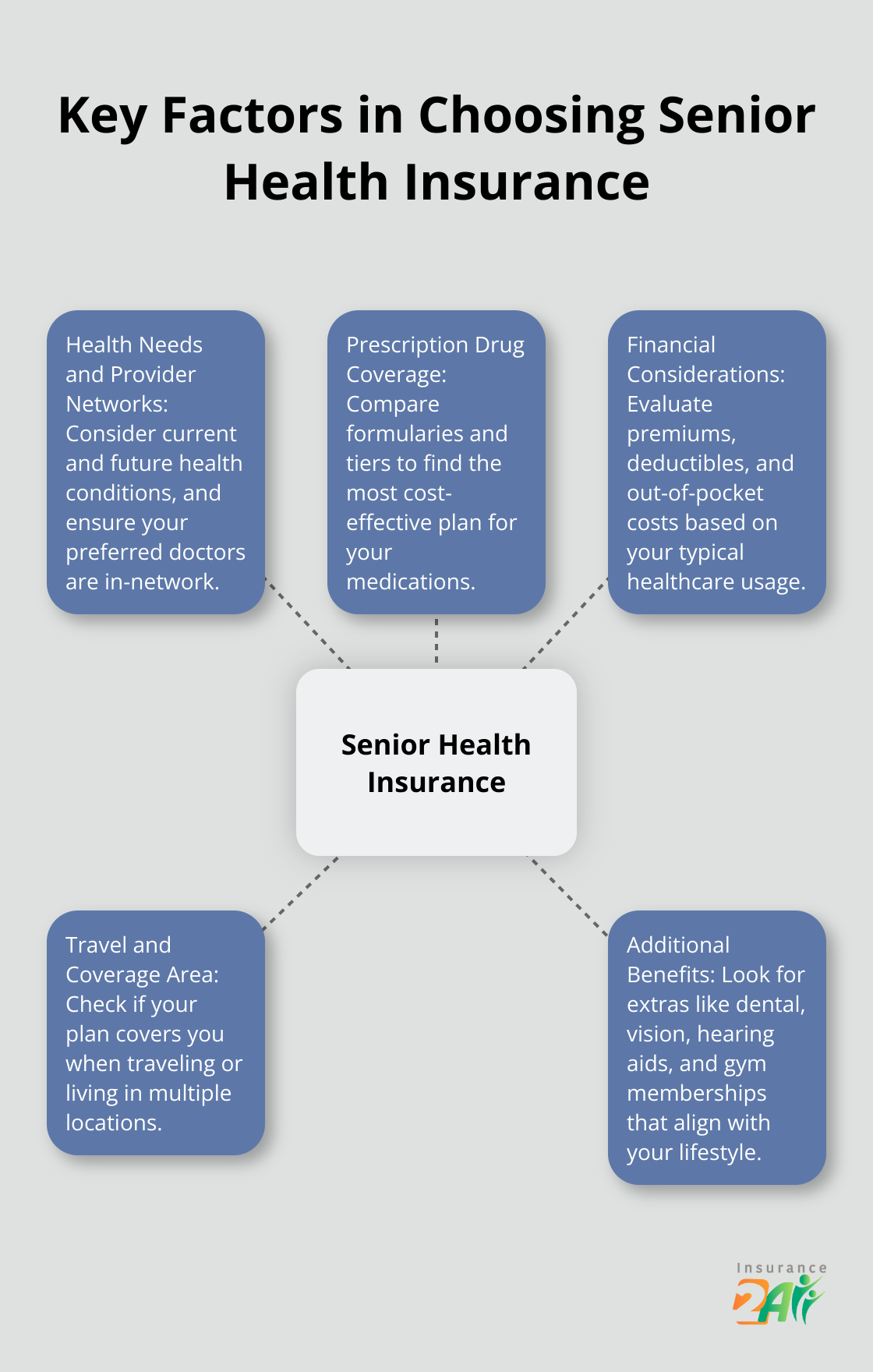

Health Needs and Provider Networks

So, what’s the deal with your health… right now, and down the line? If you’re juggling chronic conditions or doing the rounds with specialists, you’re gonna want a plan built like Fort Knox-lower copays and a sprawling specialist network. Dive into the Center on Health Equity & Access if you’re curious about smashing health care barriers. A rockstar plan can slash those out-of-pocket nasties.

When scoping out provider networks, it’s all about whether your doc’s got the backstage pass. Don’t shy away from calling them up to see which plans they roll with.

Prescription Drug Coverage

Think meds… think a cash vortex. Especially when juggling various ailments. Scout those formularies-lists of what’s covered-and watch for tiers, people. Higher tiers mean you’re parting with more cash for those meds.

Leverage tools like Medicare’s Plan Finder to enter your pill list and pit the costs against each other. This little hack? Could save you a monthly boatload, no kidding.

Financial Considerations

A cheap premium plan? Could be a mirage, leading you down the garden path. Crunch those numbers-premiums, deductibles, and out-of-pocket love notes based on how you typically dance with healthcare. And yep, tally up any subsidies or assistance you may wrangle.

Travel and Coverage Area

World traveler? Or more like bi-coastal between two homes? Check how your insurance pans out beyond your base camp. Some plans are country-wide chameleons, others are as local as the corner store. Medicare Advantage? Yeah, it might be playing in a smaller ballpark compared to Original Medicare.

Additional Benefits

These days, plans are packing extras like dental, vision, hearing aids, gym passes, and even meal deliveries. Not the main draw, but nice-to-haves if they jive with your lifestyle.

Remember, the right plan today could be the wrong suit tomorrow. Health evolves, finances change-it’s a dance, folks. Next up, more coverage angles to juice up your health insurance and keep your cash and well-being bopping along nicely.

Beyond Basic Coverage… Enhancing Senior Health Protection

Let’s face it, folks-senior health coverage often needs a little more juice than what basic Medicare serves up. Why? Because peace of mind? It’s not just a feeling-it’s a strategy.

Long-Term Care Insurance… Safeguarding Your Future

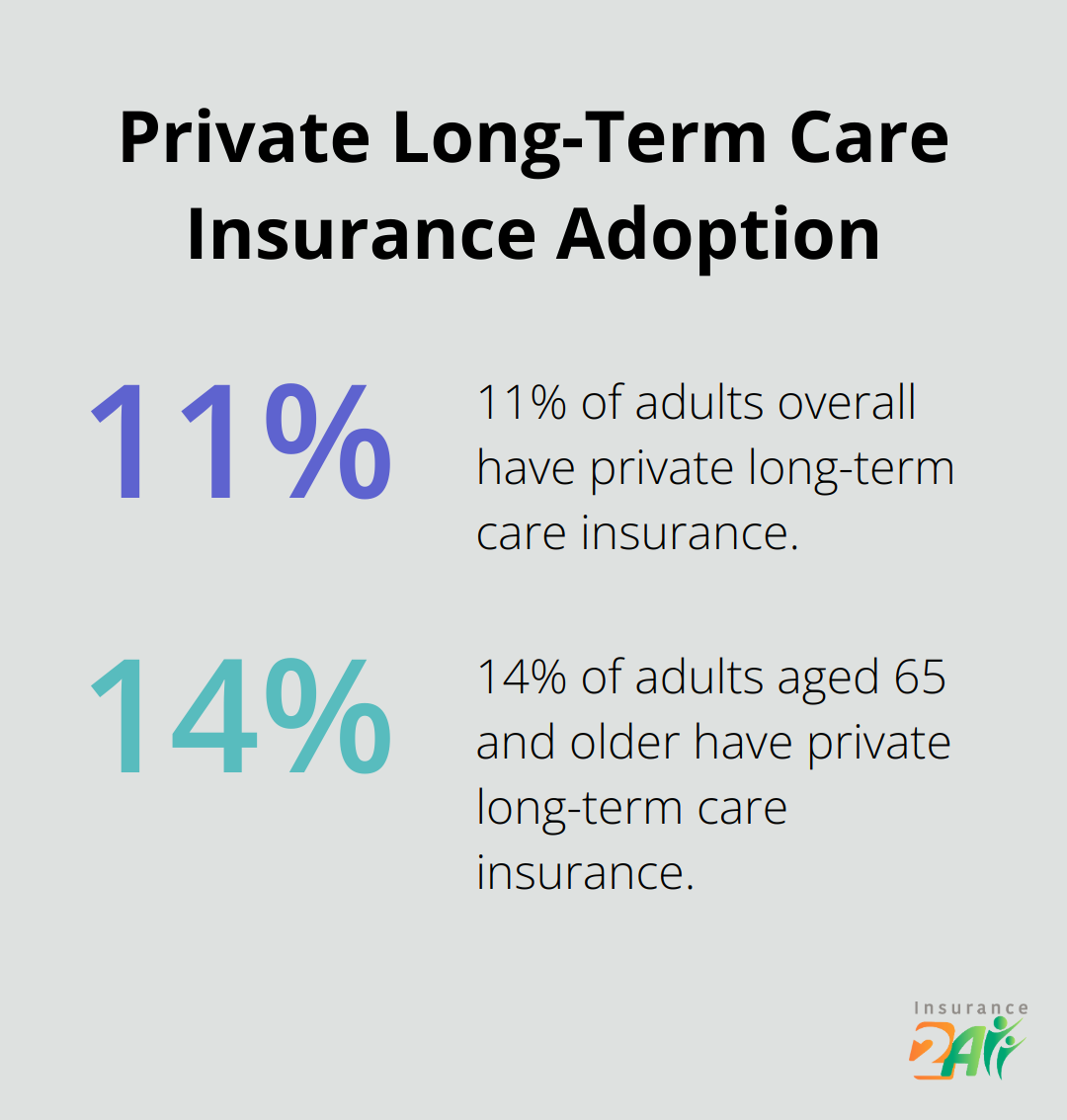

Long-term care insurance? Yep, it’s a biggie. One in ten adults (11%) claim they’ve snagged a private policy, including 14% of those aged 65-plus. This stuff picks up the tab for what regular health insurance just waves at (daily activity help, nursing home care, you name it).

Now, the cost of a private room in a nursing home… crosses $100K per year. Yikes, right? So, grabbing long-term care insurance early-when health is still on your side-is wisdom incarnate. Wait too long? Watch those premiums spike.

Dental and Vision Coverage… Filling the Gaps

Word on the street-Original Medicare (Parts A and B) leaves dental, vision, and hearing out in the cold. Luckily, many Medicare Advantage plans step in to cover some of these bases.

Let’s talk eyes-the American Optometric Association rings the bell on annual exams post-60, because catching eye problems early is the play. And standalone dental and vision plans? They start at $20-$50 a month, making them a no-brainer for avoiding high costs later.

Hospital Indemnity and Critical Illness Insurance… Financial Buffers

Here’s the scoop-hospital indemnity plans dish out a fixed daily benefit during hospital stays. Translation? They help chip away at hefty deductibles and copayments. Considering the average stay racks up over $11K, this coverage is more than a good idea-it’s financial CPR.

Critical illness insurance? Cuts a lump-sum check when the big bads hit (heart attack, stroke, cancer). Use the dough for anything from medical bills to your living expenses-talk about bending with the punches.

Navigating Additional Coverage Options

Seniors, it’s time to strategize-what’s your combination of coverages for total health and financial armor? Insurance 2ALL has you covered, with tailored solutions that help you make sense of the Medicare maze… without breaking the bank.

Final Thoughts

Senior health insurance – a veritable buffet of choices, from Original Medicare to Medicare Advantage, Medigap, and Part D prescription drug plans. Each option plays its own unique role in the ever-complex healthcare landscape. Then there’s the supplementary stuff – long-term care, dental, vision, and hospital indemnity insurance – to layer on top for extra cushions of safety.

But here’s the thing… your health needs, your wallet situation, and your everyday grind – they all matter big time when zeroing in on the right senior health insurance. It’s not one-size-fits-all… what works for Grandma Jane might not be the ticket for Uncle Joe. You’ve got to kick the tires, size up your own world when making the call.

Enter Insurance 2ALL. We get it – the twists, the turns, the ins and outs of senior health insurance. We’re here – armed and ready – to help you navigate the Medicare maze and break down the nitty-gritty of coverage choices. Our affordable, comprehensive health insurance solutions are designed just for you.