Insurance 2ALL…yeah, it’s a jungle out there, especially if you’re a small business owner trying to make sense of health insurance. It feels like you need a degree just to understand the basics (spoiler: you don’t, but it sure helps).

Got unique needs? Special challenges? Yep, that’s what being a small business owner is all about—especially when it comes to healthcare for you and your crew. This guide? It’s here to shine some light and help you cut through the noise.

We’ll break it down for you—lay out the options and guide you step-by-step. It’s about finding the right health insurance to fit your business like a glove.

Let’s dive into how you can keep your team’s health in check without sending your budget into a tailspin.

What Health Insurance Options Do Small Business Owners Have?

Alright, small business owners-you’ve got your hands full, no doubt. Health insurance? It’s a beast of its own… Let’s dive into the main types of health coverage on the menu for you and your crew.

Group Health Insurance Plans

So, you’ve got group health insurance. The crowd favorite for small businesses, this plan ropes in all eligible employees (yeah, even their dependents get in on the action). The kicker? Cost-sharing! Employers and employees chipping in means premiums that won’t break the bank… as much.

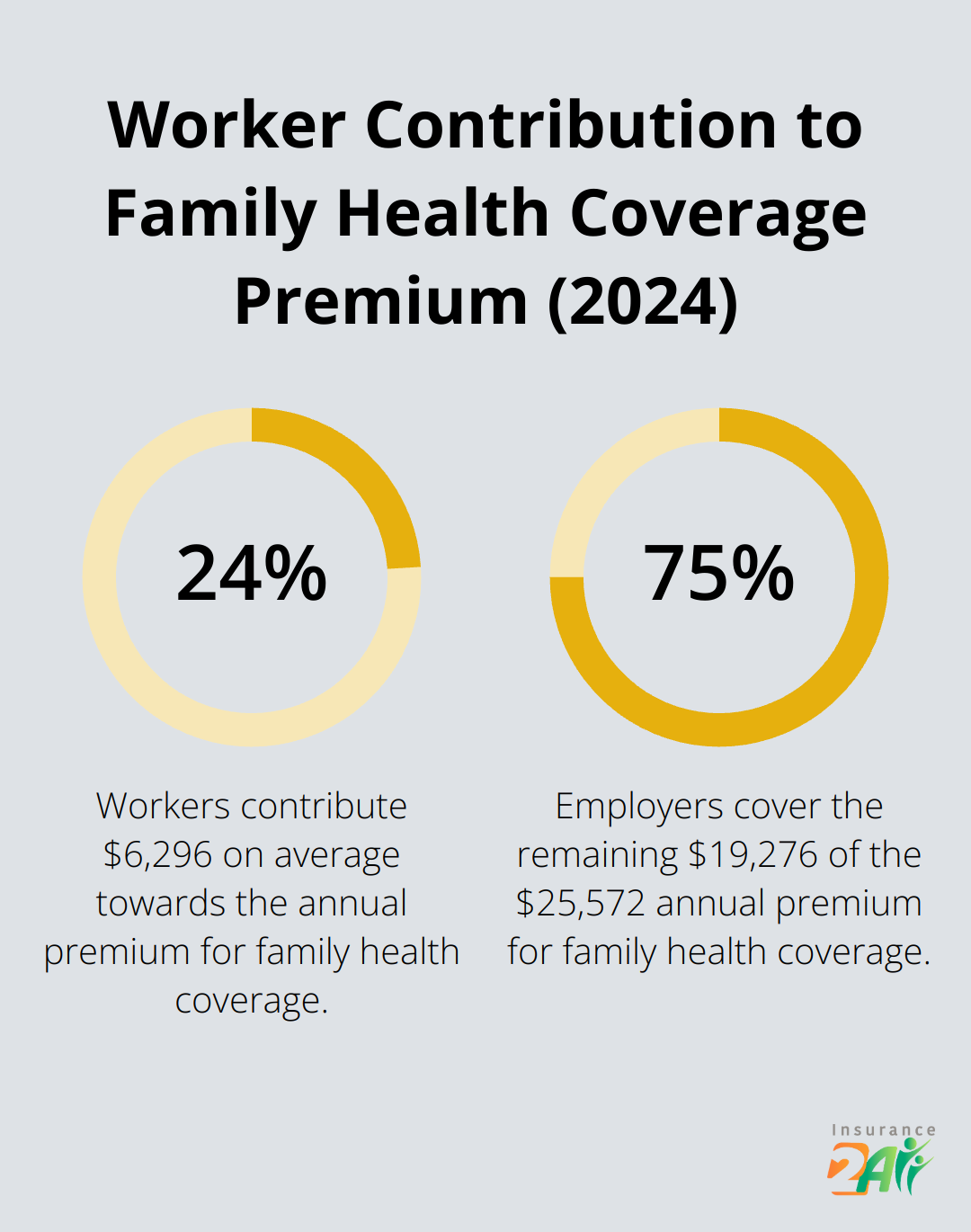

Hit you with some stats-2024 saw annual premiums for employer-sponsored family health coverage at $25,572. That’s a 7% jump from last year. Workers? They’re shelling out $6,296 on average toward this beast of a premium, per the Kaiser Family Foundation.

Individual Health Insurance Plans

Running a tight ship or sailing solo? Individual health insurance might be your jam. Snag these plans straight from the insurance big shots or through the Health Insurance Marketplace.

Snap to this: 14.5 million folks were on board with individual market plans in 2024, per the National Association of Insurance Commissioners. This pick gives you some serious wiggle room-your employees can zero in on what suits them best.

Health Savings Accounts (HSAs)

Here comes the twist-not an insurance plan, but HSAs are your high-deductible health plan’s trusty sidekick. They’re all about setting aside that pre-tax moolah for future medical curveballs.

Brace yourself-Devenir Research laid it out… by mid-2024, HSA assets were chilling at $137 billion, spread across almost 38 million accounts. That’s an 18% climb, folks.

Professional Employer Organizations (PEOs)

For a small business, tapping into PEOs can be pure wizardry. Outsource those pesky employee management tasks (yep, including health benefits stuff). According to the National Association of Professional Employer Organizations, businesses with a PEO arrangement? They’re 7-9% sprightlier in growth than the rest.

Making the Right Choice

Each option’s got its grooves, but what’s your best bet? It’s all about your biz specifics, budget vibes, and what your crew holds dear. Look at your workforce size, wallet status, and the benefits that’ll make your team do a happy dance.

As you mull this over, keep an eye on how it meshes with your corporate dreams. Nail the right health insurance plan, and it’s like magnets to steel for top talent, sky-high employee vibes, and-it all comes full circle-sweet success for your company.

We’ve scoped out the health insurance landscape for small biz owners… Now, it’s time to piece together the magic for your tailored needs.

How to Pick the Perfect Health Plan for Your Small Business

Assess Your Financial Landscape

First things first, small business champs, you gotta get a grip on those finances. The Kaiser Family Foundation reports that in 2024, the sticker shock for employer-sponsored health insurance hits $8,951 for single peeps and $25,572 for families. Now that’s a big ol’ chunk of change that demands some smart budgeting.

Craft a budget that’s not just pie-in-the-sky. Figure out what’s doable per employee and what they’re expected to kick in themselves. (Ponying up at least half the premium might just score you some sweet tax credits courtesy of the Small Business Health Options Program.)

Understand Your Team’s Needs

Here’s the real heartbeat of your biz-your people. Their health needs? Top shelf priority. Roll out a survey and figure out what floats their boat in a health plan. Are they all about low deductibles, or is it comprehensive drug coverage they’re after? Maybe they’ve got a favorite specialist they can’t live without?

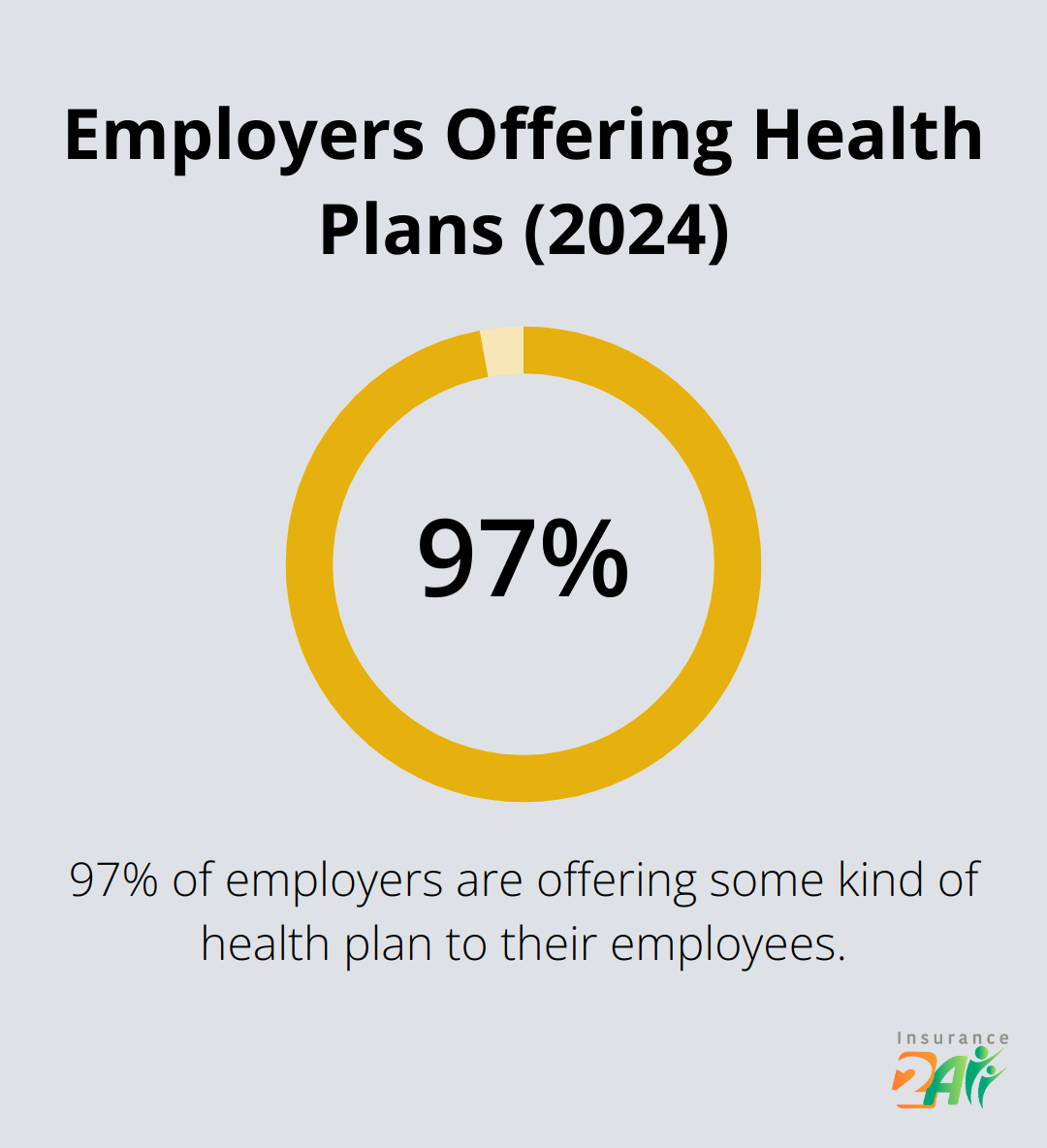

The Society for Human Resource Management says that a whopping 97% of employers are dishing out some kind of health plan. Keep your crew happy and sticking around by syncing your plan with what they’re after.

Conduct a Thorough Plan Comparison

It’s shopping time-and I don’t mean the fun kind. Compare at least three options. Here’s your checklist:

- Monthly premiums (yep, those annoying regular payouts)

- The nitty-gritty on deductibles and out-of-pocket max

- How much you’re actually getting for coverage

- Prescription drug perks

- Preventive care goodness

The SHOP Marketplace can lay ’em side by side for you. (And be on the lookout for that Small Business Health Care Tax Credit-might just shave off up to 50% of those premiums.)

Evaluate Provider Networks

Meanwhile, a plan’s real power is in its network. Hunt down ones with a solid web of docs, hospitals, specialists, the whole nine yards. You don’t want your team squinting at directories like they’re treasure maps.

Hit up potential insurers for provider directories, and do some cross-referencing with your employees’ fave healthcare providers. Aim for a 90% match rate-nobody loves a surprise out-of-network bill.

Next up is navigating the application jungle and actually launching this whole shebang for your biz. Strap in, let’s make this happen.

How to Get Health Insurance for Your Small Business

Research Insurance Providers

Alright, small business warriors-start by scoping out top dog insurance providers in your zip code. Dive into ratings from J.D. Power or the National Committee for Quality Assurance. Think of these as your Yelp reviews for healthcare… minus the emojis. Their wisdom will give you the 411 on who’s delivering satisfaction and who’s just coasting.

Chit-chat with fellow small business owners about their hit-or-miss experiences. And don’t shy away from dialing up a licensed insurance broker (it’s like having a guide through a bureaucratic jungle). They might point you to solutions you didn’t even know existed-and maybe even give your budget a break.

Prepare Necessary Documentation

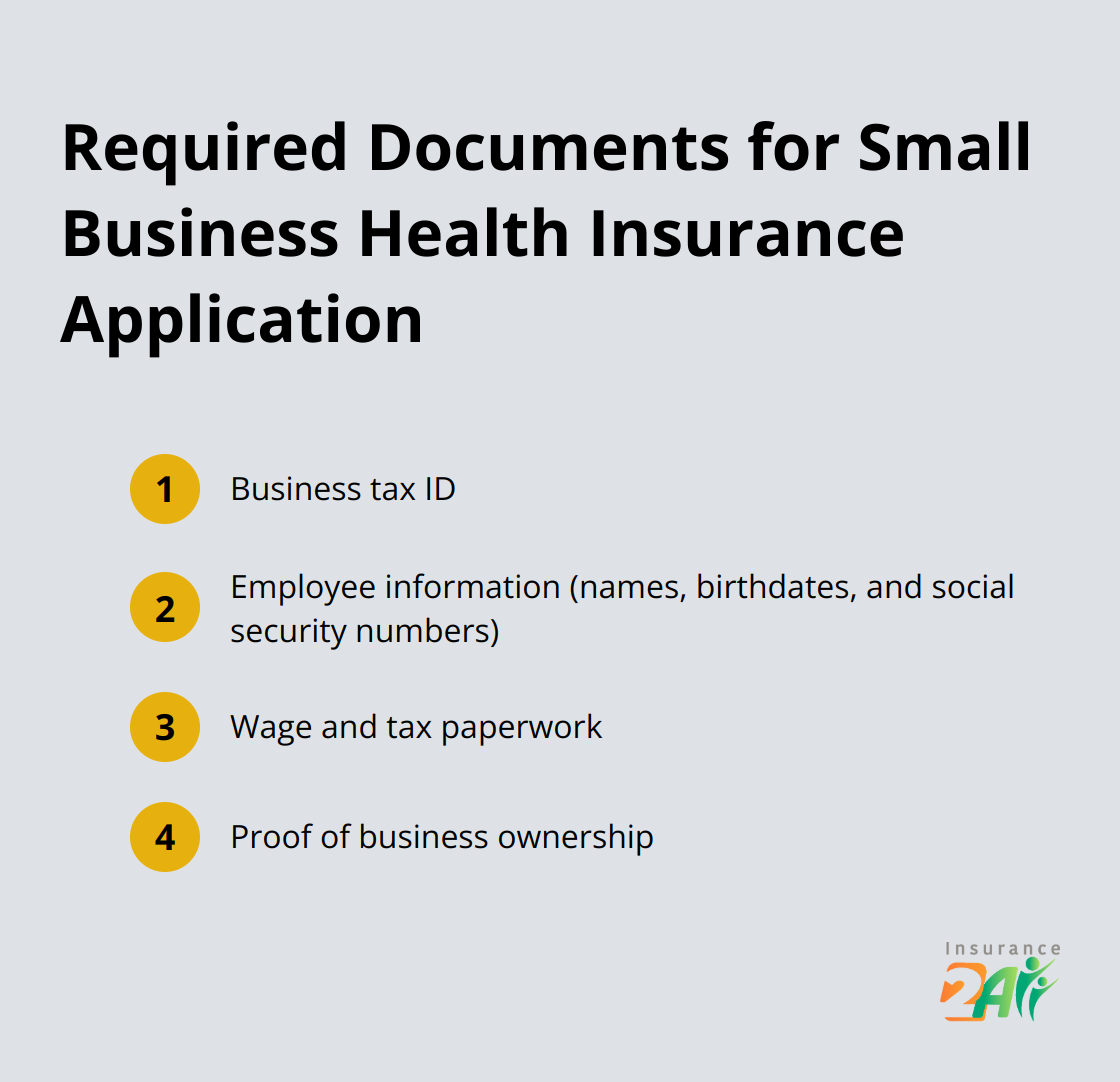

When it comes to applying, preparation is your best friend-avoid that classic last-minute scramble. Here’s your no-fail checklist:

Get these docs locked and loaded to fast-track your application and sidestep snags.

Apply for Coverage

You’ve done the homework, now it’s time to submit… Go the SHOP route online or partner with a SHOP-savvy agent or broker. This adventure typically involves an employer application plus an employee roll call.

Heads up-brace yourself for back-and-forthing with the insurance folks. They might ping you for more data or to clear up fuzzy details. Keep those responses snappy to keep the train rolling. And hey, circle key enrollment dates on your calendar to ensure coverage kicks in when you’re counting on it.

Inform Your Employees

You’ve snagged the plan, now it’s show-and-tell time with your crew. Set up a company jam session to break down the benefits. Hit all the major beats:

- When the coverage goes live

- The step-by-step enrollment guide

- What the plan covers (and what’s off the table)

- Employee contribution figures

Whip up a benefits guide that spells things out plain as day-complete with FAQs and a hotline to the insurance provider’s customer service. Get it right now, avoid a headache later.

Consider Additional Options

Why stop at the usual suspects? Peep alternatives like Health Savings Accounts (HSAs) or Professional Employer Organizations (PEOs). They might add a dash of flexibility and maybe keep some more green in your wallet.

This is where you find your Goldilocks zone-not too hot on coverage, not too cold on costs. Protect your team’s health without sending your business finances into a tailspin.

Final Thoughts

Health insurance for small biz owners-yeah, it’s a beast. But a beast with big-time rewards. Group plans, individual options, HSAs, PEOs… each one’s got its own vibe. The trick? Match ’em up with your business’s needs and wallet. This decision? It’s gonna shake up employee satisfaction and your bottom line. Dive deep and put your squad’s health needs up top.

Alright, the whole application gig? It ain’t a walk in the park. Prep like a champ, gather your docs, and boom-you’re on your way to snagging the right coverage. Now, shout it from the rooftops-clear communication about these shiny new benefits smooths the road for your crew. Going all in on health insurance shows your team you care, and-bonus-it may just lure in that rockstar hire.

Insurance 2ALL totally gets the head-spinning world of small biz health insurance. Our savvy pros will hold your hand through the maze to land on affordable, comprehensive coverage that fits your biz (and budget) like a glove. Get cracking today to build a healthier, more turbocharged team-your biz and crew will thank you.