Missed the open enrollment period for health insurance? No stress—you’re not stuck without options.

At Insurance 2ALL, we get it—life’s curveballs rarely consult your calendar. That’s why we’re ready to walk you through how to snag health coverage even after the enrollment gates have slammed shut.

Here, we’re diving into the backup plans to ensure you and your family aren’t left hanging… whenever you need that safety net.

What Are Special Enrollment Periods?

Special Enrollment Periods (SEPs) – they’re like a safety net ready to catch you when the regular enrollment hoop is missed. Why do they exist? Simple. Because life’s messy and rarely consults your calendar.

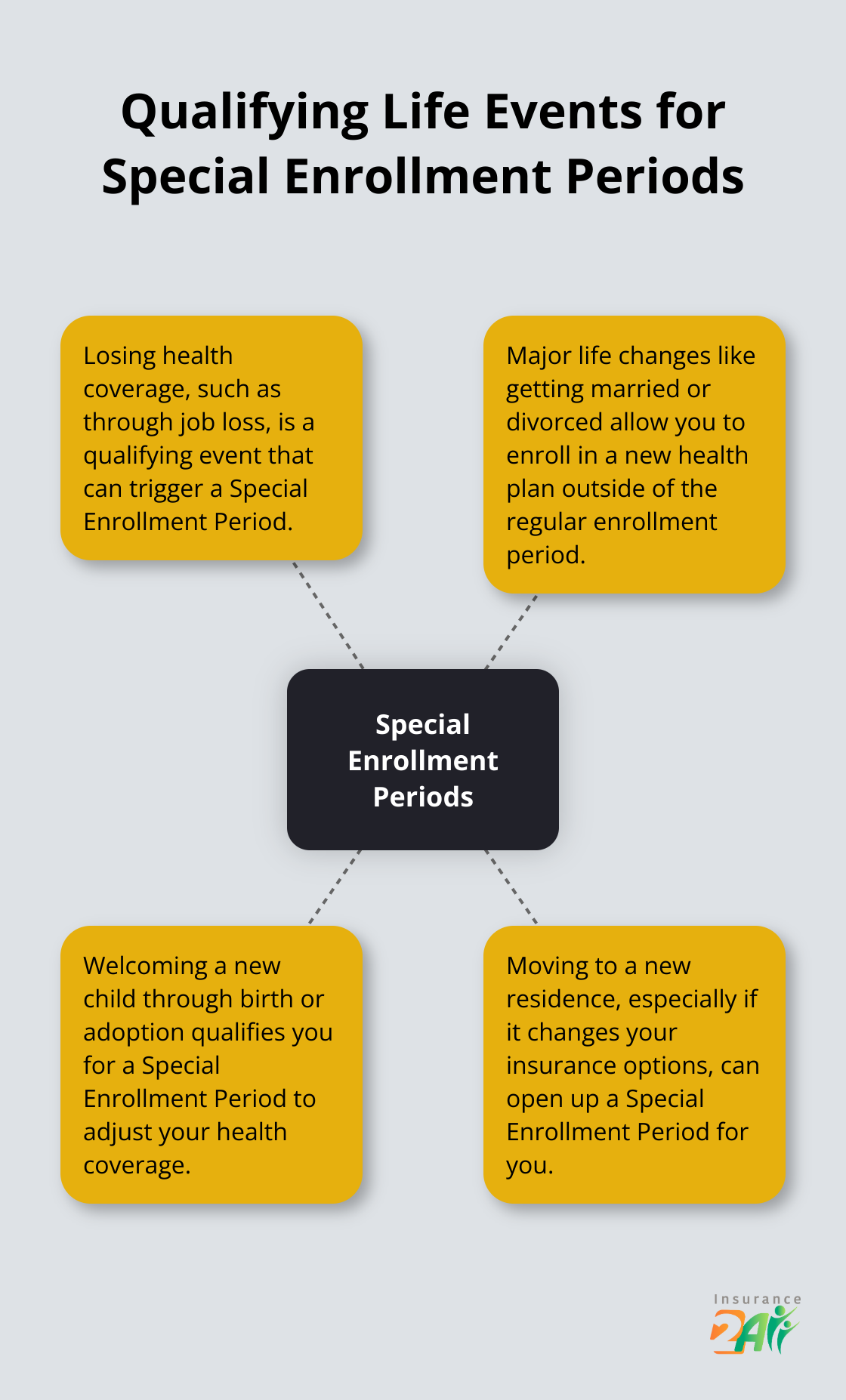

Qualifying Life Events

SEPs kick into gear with a qualifying life event. What does that mean? It’s when life throws you a curveball, and your insurance needs a pivot. The usual suspects include:

- Losing health coverage (think: job loss shuffle)

- Tying or untying the knot

- A new child – by birth or adoption

- Packing up for a new zip code

Time Frame for Action

Now, SEPs aren’t open-ended invites. You’ve got a ticking clock – usually 60 days from your life-changing event to sign up for a new plan. Miss it? You might be stuck waiting for the next open enrollment.

Required Documentation

To play the SEP card, you need to back it up. It’s showtime for your documents, like:

- Baby’s birth certificate hits the stage

- Employer’s farewell letter (job loss)

- New digs? Prove it with a fresh address

Importance of SEPs

Surprisingly, many folks don’t even know they qualify for an SEP until they trip over one. If life flips your world, get in touch with an insurance pro… pronto. They can help steer you toward the coverage you need.

Health insurance – it’s your bodyguard for both health and wallet. So, don’t let procrastination turn into vulnerability. Think you might fit the SEP bill? Act swiftly. Time’s not your pal here; once that life event happens, the countdown is on – tick-tock on securing your protection.

Let’s move further into territory where traditional enrollment periods don’t rule the day. Exploring these alternatives could become your safety net if SEPs don’t fit your situation.

Beyond Open Enrollment: Your Health Coverage Options

When the doors slam shut on open enrollment-don’t panic, you’re not left hanging. Life’s curveballs don’t respect those deadlines. So, what’s next? Let’s dissect your health coverage playbook.

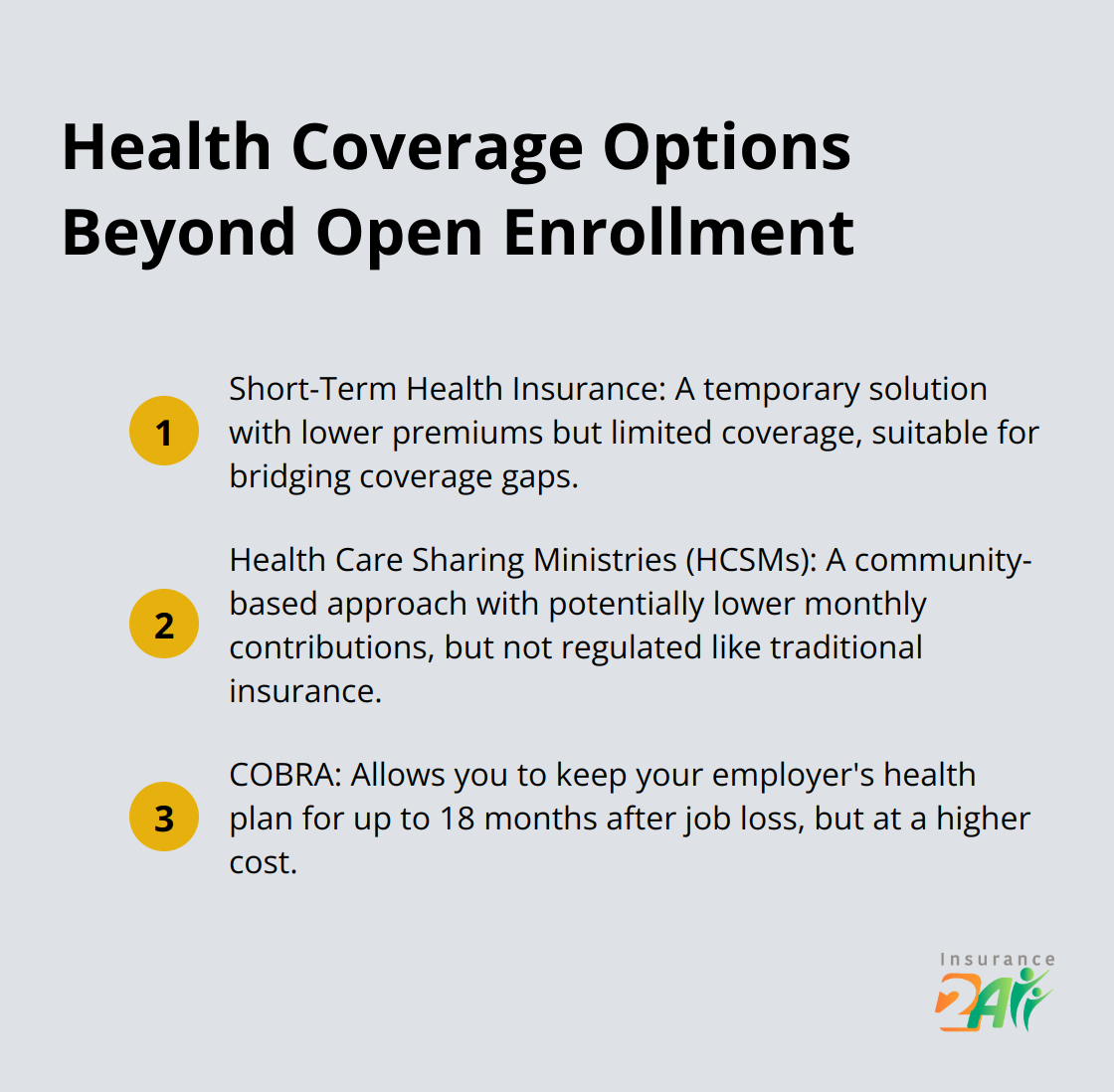

Short-Term Health Insurance: A Quick Fix

Ever need a Band-Aid? That’s short-term health insurance for your coverage gaps. You get lower premiums, sure, but there’s a catch-limitations. They’ll cover your sudden health hiccups but won’t play nice with preventive care or pre-existing conditions. Now, if we’re talking ACA, it’s the full enchilada: comprehensive coverage with protections. Short-term? Just a temporary, sometimes cheaper stand-in.

Health Care Sharing Ministries: A Community Approach

Then there’s the quirky cousin at the insurance family reunion-health care sharing ministries (HCSMs). You’re in for potentially lower monthly contributions than your classic premium. It’s not insurance, more like a communal kitty-feels good, might save you cash. But don’t get too comfy. These aren’t regulated like insurance. No guaranteed payouts, and they might frown on your lifestyle choices or pre-existing conditions. Know the stakes before you buy in.

COBRA: Keeping Your Employer Plan

Ah, COBRA-your trusty fallback when the job market ghosts you. This little lifeline lets you cling to your employer’s health plan for up to 18 months. Your coverage stays put, but brace yourself-you’re shouldering the entire premium with a bonus 2% administrative cherry on top.

Navigating Your Options

Overwhelmed yet? No need to go it alone. Call in the pros-insurance gurus like those at Insurance 2ALL are your navigators through these hustles. They’ll help you nail the coverage puzzle, whether it’s a short-term stopgap or something off the beaten path like HCSMs. They’re on call, every day of the week, offering clear-eyed guidance.

Now, let’s pivot to year-round enrollment options that’ll keep you covered when life decides to get interesting.

Medicaid and CHIP: Year-Round Safety Nets

Understanding Medicaid and CHIP

Medicaid and the Children’s Health Insurance Program (CHIP) – think of them as the rescue nets below the tightrope of traditional health insurance. When the usual options falter, these government-backed lifelines swoop in, delivering crucial coverage to countless Americans who’d otherwise be adrift without insurance. Not something you want to roll the dice on, right?

Eligibility Criteria

So, who gets to hop on board? It’s all about the fine print of income, household size, and age. States that jumped on the Medicaid expansion bandwagon under the ol’ Affordable Care Act-yep, some adults under 65 with income up to 138% of the poverty line can join the club. Then there’s CHIP, rolling out the welcome mat for kids in families with incomes up to double the poverty line, even if their folks can’t crash the Medicaid party.

And let’s not forget-some groups (think pregnant women, kids, and those with disabilities) have different thresholds. It’s a state-by-state affair, with eligibility swinging between the modest 170% and a generous 400% of the Federal Poverty Level. Yeah, it’s a bit of a patchwork quilt.

Application Process

Getting your foot in the door? Not rocket science. Hit up your state Medicaid agency or the Health Insurance Marketplace with your application-many states now let you do it all online because, let’s face it, paper forms are so last decade.

You’ll need to bring the goodies:

- Proof of income (those pay stubs and tax returns you had lying around)

- Proof of residency (yes, you gotta prove you live where you say you do)

- Social Security numbers for the whole gang

- Info on any other health coverage you’re juggling

Expect a waiting game-up to 45 days-but if you’re in a pinch, they might fast-track it. Denied? You get to say, “I object,” and appeal.

Program Benefits

Here’s the sweet spot-these programs hand out comprehensive coverage, often with little to no cost to those signed up. We’re talking:

- Doctor visits and hospital stays (check)

- Preventive care (vaccines, screenings-the works)

- Prescription drugs

- Mental health services (because it’s all up here, folks)

- Dental and vision care for the kiddos

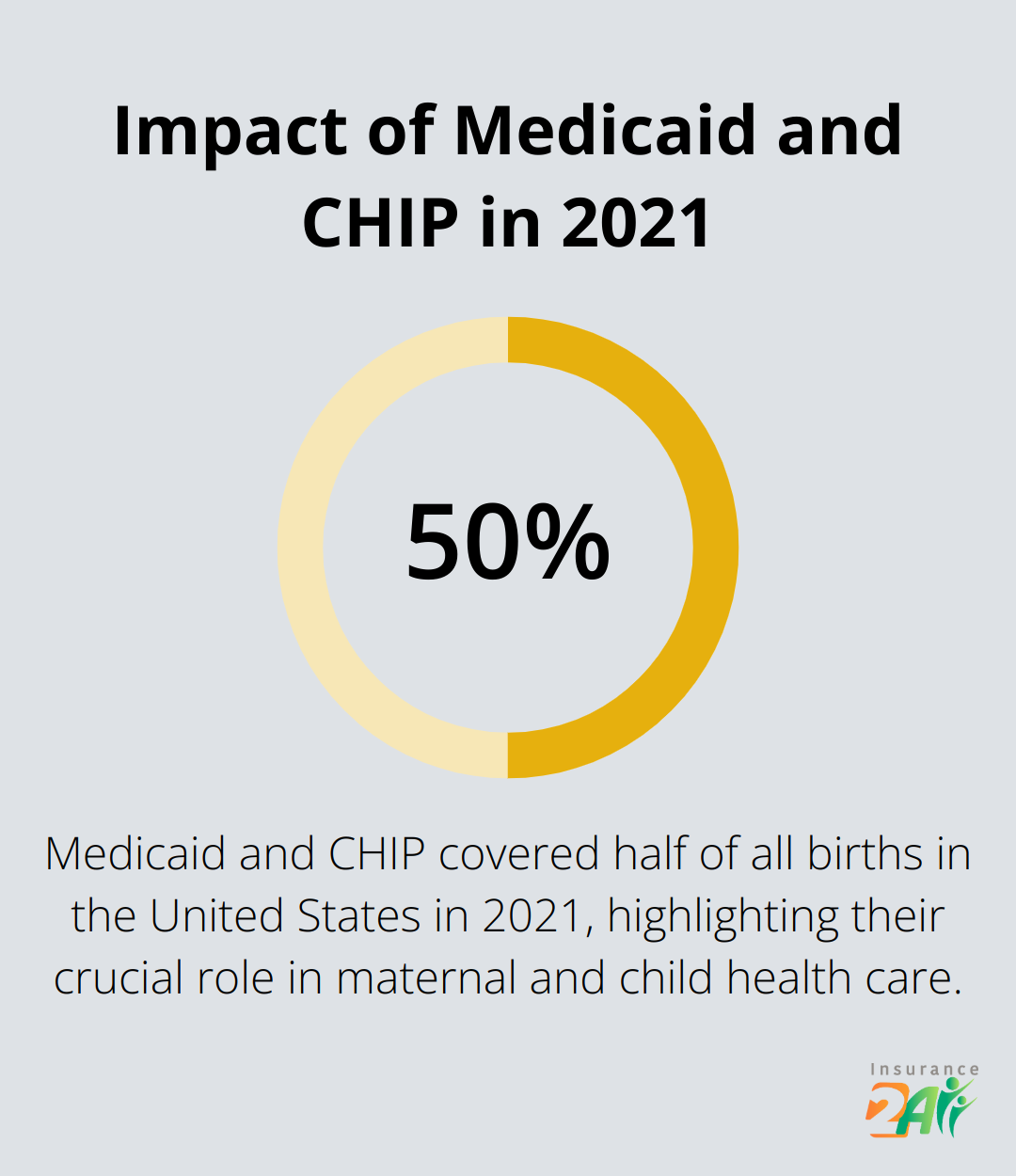

Back in 2021, Medicaid and CHIP were the safety nets for over 87 million Americans-half the nation’s births included. Those numbers? They don’t just whisper; they shout about the pivotal role these programs play in our healthcare landscape.

Navigating the Process

Now, while Medicaid and CHIP offer solid coverage, the paperwork maze can feel like you’re navigating the Bermuda Triangle. That’s where insurance pros strut in-they’ll help decode your eligibility and shepherd you through the hoops. Because nothing beats having the coverage you need, precisely when you need it.

Final Thoughts

Schedules? They’re for trains and flights-health coverage should be flexible. We dove into ways to snag health coverage after open enrollment-Special Enrollment Periods, short-term plans, you name it. And let’s not forget Medicaid and CHIP, the unsung year-round heroes keeping folks health-secure and pocket-friendly.

At Insurance 2ALL, we know that trying to decode health insurance can give you a migraine. Our crew of pros is here to be your GPS-whether you’re eyeing Obamacare or checking out Medicare. We’ll tailor the map to your budget and needs, so you’re covered without breaking the bank.

So, the end of open enrollment isn’t a dead end. Hit up Insurance 2ALL today, and let’s get you that health coverage you’ve earned. Our friendly team’s ready to chat and steer you toward smart choices for your health insurance (yep, every day of the week).