Expecting a baby? Congrats! Navigating the labyrinth of maternity health coverage—it’s kinda crucial on your parenthood journey, right?

At Insurance 2ALL, we get it—the world of health insurance? A total maze. Toss in the prep for a new mini-you, and it’s a whole new level of overwhelming.

This guide’s got your back. We’re talking about how to pick the best maternity health coverage, ensuring you and your little one get top-notch care… without emptying the piggy bank.

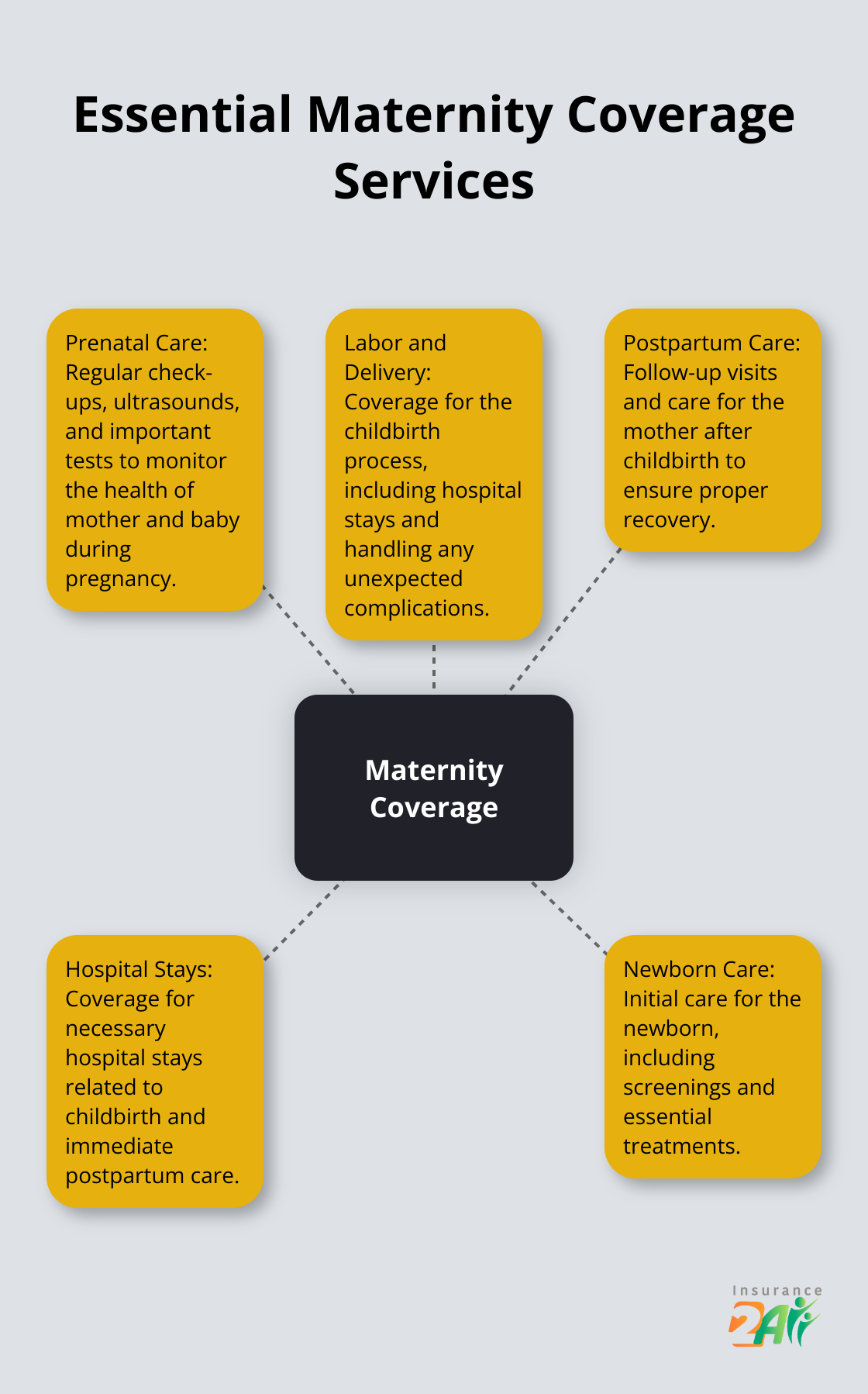

What Maternity Coverage Includes

Essential Services Covered

So when they say “maternity coverage,” what are they really talking about? It’s the whole shebang – prenatal care, labor and delivery, and postpartum care. Your plan should be your wingman for regular check-ups, ultrasounds, and all those tests everyone tells you are “oh-so-important.” Got it? Hospital stays for childbirth and handling any curveballs – covered.

Key Benefits to Look For

Now, when you’re shopping around for a plan, keep your eyes peeled for coverage that dishes out:

- Comprehensive prenatal care

- Dollars for hospital stays and delivery

- Postpartum care (you’ll need those follow-up visits)

- Newborn care (yes, that’s important too)

- Breastfeeding support (and gear to make it bearable)

And hey, some plans toss in extras like childbirth classes or access to lactation consultants. These aren’t just fluff – they’re golden for new parents.

Impact of the Affordable Care Act

Thank the Affordable Care Act (ACA) for its cameo in better maternity coverage. Since it took the stage, all marketplace health plans must treat pregnancy and childbirth like rockstar essential health benefits. Translation: insurers can’t play games by denying you coverage or cranking up the price tag just because you’re expecting.

Understanding Your Specific Coverage

Need a reality check? These are general vibes, but every plan’s got its quirks. Make like a detective and sift through your details. Look for the nitty-gritty about:

- Prenatal visit copays (because, oh yes, they might lurk there)

- Specialized test coverage (like genetic screening hotshots)

- How long they’ll bankroll your hospital stay for delivery

- Coverage for those “wait, what now?” complications

Navigating Your Options

Drowning in choices? No sweat, you’re not solo on this ride. Insurance experts (those folks at Insurance 2ALL) can decode the matrix and help you snag a plan that vibes with your needs. They’ll lay out all the details like the family drama at Thanksgiving and make sure you’ve got the coverage you and your soon-to-be bundle really deserve.

As you cruise through your maternity coverage options, take a sec to think about how these plans sync with your whole healthcare ecosystem. Let’s dive into what factors you should chew over when choosing your maternity coverage.

What Factors Matter Most for Maternity Coverage?

Your Health and Pregnancy Status

Alright, let’s break it down. Your current health situation and pregnancy status-are they a big deal? You bet they are. Already got a bun in the oven? You’re gonna need a plan that rolls out the red carpet for prenatal care-fast. Contemplating starting a family? Scout for something that doesn’t put you on hold with endless waiting periods for maternity benefits.

And let’s not sideline the usual suspects: pre-existing conditions. Post-ACA, over 70% who snagged insurance post-came with that baggage. ACA’s got your back by telling insurers to take a hike if they plan to charge extra or deny coverage for these conditions. But hey, you’ll still need a plan that’s got the bandwidth for ongoing health considerations.

Your Preferred Healthcare Providers

Got a VIP spot in your heart for a specific OB-GYN or hospital for the big day? Check if they’re on the list for the plans you’re batting an eye at. Sidebar: Out-of-pocket costs for those growing a tiny human? They’re about $2,854 higher than for your typical peers. It’s like an extra layer of financial reality.

The True Cost of Your Plan

Plans aren’t just about the shiny number at the top-premiums. Drill deeper. Look at the deductible, copayments, and out-of-pocket max. The low premium might catch your fancy, but if the deductible hits like a ton of bricks, you might end up digging deeper into your wallet.

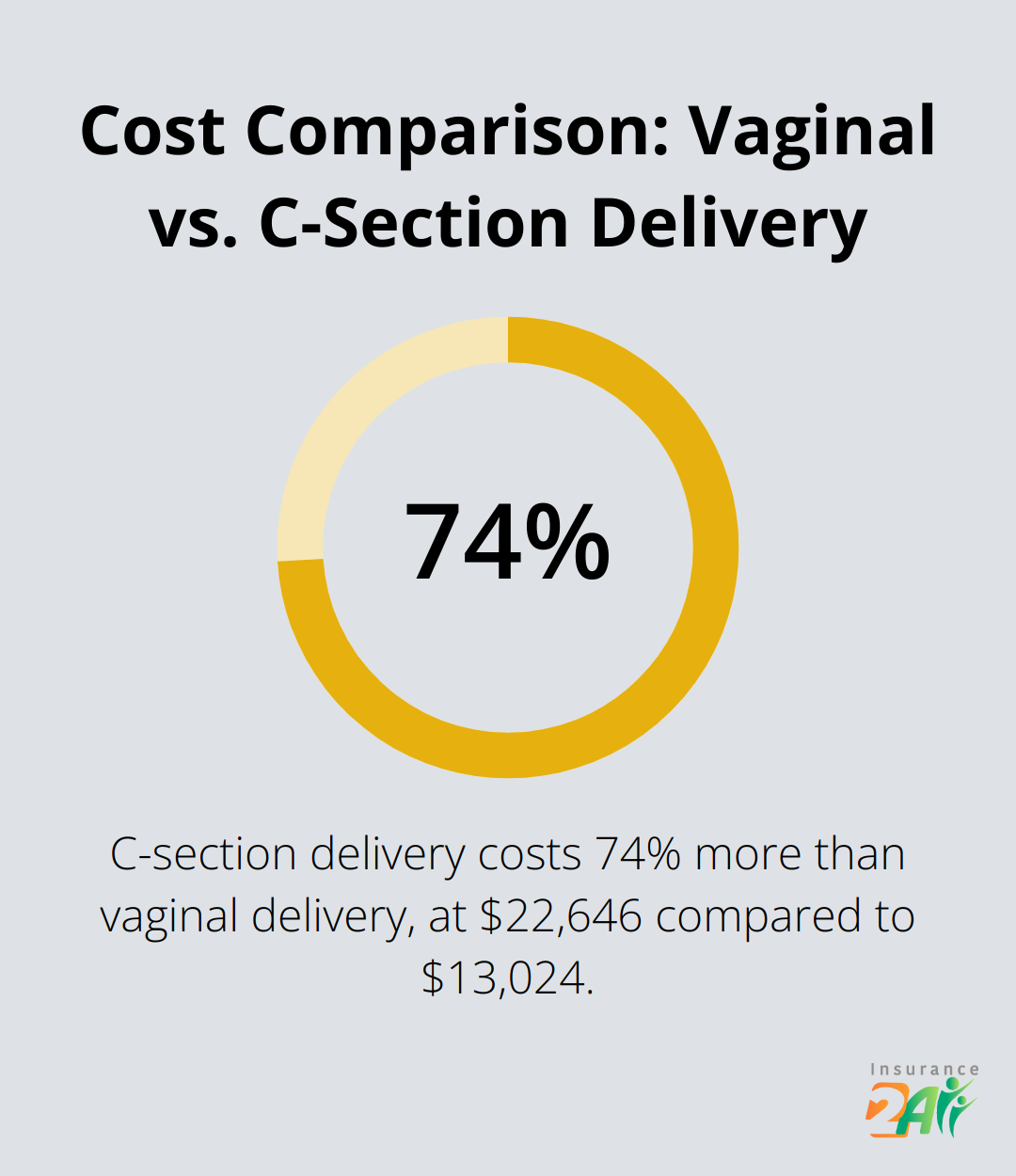

Some wisdom from The American College of Obstetricians and Gynecologists: low-risk prenatal care runs you about $2,000. Then, you’ve got the grand entrance: delivery-going for about $13,024 if you go old school (vaginal) or $22,646 if it’s C-section (FAIR Health says hello). Your plan’s quirks will determine your wallet’s fate, so get your Sherlock hat on and scrutinize those plan structures before signing the dotted line.

Coverage for Prenatal and Postnatal Services

Cast a wide net for a plan that hands you the full suite of prenatal and postnatal care. This star lineup should include regular tune-ups, ultrasounds, and need-to-know tests during the baby-baking phase. Don’t skip out on postnatal care-covering follow-up visits, lactation support, and those first crucial steps in newborn care.

Additional Benefits and Support

A handful of plans throw in some nifty perks for soon-to-be parents. Think childbirth education classes, lactation experts ready to coach, or even home visits from nurses. Especially handy for first-timers, these extras might not dictate the deal but can certainly sweeten the whole experience.

While you’re juggling these factors, remember to scope out the different health insurance flavors out there. Each one’s dishing out its own pros and cons in the maternity sphere.

Which Health Insurance Plan Fits Your Pregnancy?

Employer-Sponsored vs. Individual Plans

Employer-sponsored health insurance – your financial MVP when you’re expecting. Why? Well, these plans rock lower premiums and beefy coverage. According to the Kaiser Family Foundation, the 2021 average annual premium for employer-sponsored family coverage hit $22,221, with employees shouldering only about 28% of that. Sweet deal, right?

Now, if you’re self-employed or flying solo without employer coverage, head to the Health Insurance Marketplace. These individual plans might cost more, but they’re packing the essential health benefits – maternity care included – thanks to the Affordable Care Act. So, no sweat.

HMOs, PPOs, and Other Plan Structures

Next stop, plan types. Health Maintenance Organizations (HMOs) and Preferred Provider Organizations (PPOs) – major players here.

HMOs? They’re your budget-friendly option – but with a catch. Stay in-network or pay up. That favorite OB-GYN of yours out of bounds? Might have to switch. PPOs, though, offer more freedom with providers but at a premium.

So, for pregnancy – think about how much freedom you want with your docs. Got a must-have doctor or hospital? A PPO might be worth the splurge.

Special Enrollment for Pregnancy

Good news – pregnancy unlocks a Special Enrollment Period. That’s right, you can tweak or jump into a new health plan outside the regular Open Enrollment. New kiddo coming? That’s your ticket.

Savvy parents-to-be leverage this to snag better coverage – saves a bundle on out-of-pocket expenses. Smart play.

Comparing Coverage Options

Dig deeper when comparing plans. Premiums are just a slice of the pie. Check out these factors:

- Deductibles and copayments

- Out-of-pocket maximums

- Coverage for specific prenatal tests and procedures

- Postnatal care benefits

Some plans throw in extra goodies like childbirth classes or lactation support (lifesavers for newbie parents).

Seeking Expert Guidance

Feeling swamped with insurance options during pregnancy? Don’t panic. Insurance experts are your GPS. Companies like Insurance 2ALL are pros at guiding expectant parents to a tailored plan that’s easy on the wallet and meets all your needs.

Final Thoughts

Navigating the labyrinth of maternity health coverage-yep, it’s a labyrinth-demands some serious brainpower. First off, evaluate your health status… seriously, know thyself. Then, look at your preferred providers, and get down to brass tacks on the real cost of each plan (spoiler alert: it’s more than just the premiums). Compare the benefits of employer-sponsored options versus individual plans like you’re choosing between French wine and boxed wine. Each has its charm. And don’t sleep on those special enrollment periods-if you’re expecting, they’re your golden ticket to adjust your coverage in anticipation of your new arrival’s needs.

Insurance 2ALL gets it-health insurance during pregnancy is a puzzle only slightly less complex than quantum physics. But fear not. Our team will guide you through this maze to find a plan that checks all the boxes: comprehensive coverage and tailored to fit your needs and budget like a designer glove. With us in your corner, you can meet your little bundle of joy with confidence knowing you’ve scored the best possible health coverage for your growing family.

So, yes, the quest for the best maternity health coverage might eat up some time and brain cells, but the peace of mind? Absolutely priceless. Reach out for some expert guidance, because making an informed decision means you and your baby can face the future with a safety net wrapped in a pretty bow.