At Insurance 2ALL, we get it — health insurance paperwork is like trying to solve a Rubik’s cube blindfolded. Confusing? Absolutely.

This one paper, the infamous Qualifying Health Coverage Letter… yeah, it trips people up. But—here’s the kicker—it’s crucial (and we mean crucial) for proving your insurance status—taxes, law, the whole nine yards.

Stick around, and we’ll walk you through how to snag your Qualifying Health Coverage Letter and why it’s actually a big deal.

What Is a Qualifying Health Coverage Letter?

Definition and Purpose

Think of a Qualifying Health Coverage Letter as your backstage pass to prove that your health insurance vibes with the Affordable Care Act (ACA) hoops you need to jump through. This piece of paper? It’s your official “I’m covered, thank you.” Just in case you have to show some big shots that you’re all good in the health coverage department.

When You’ll Need This Letter

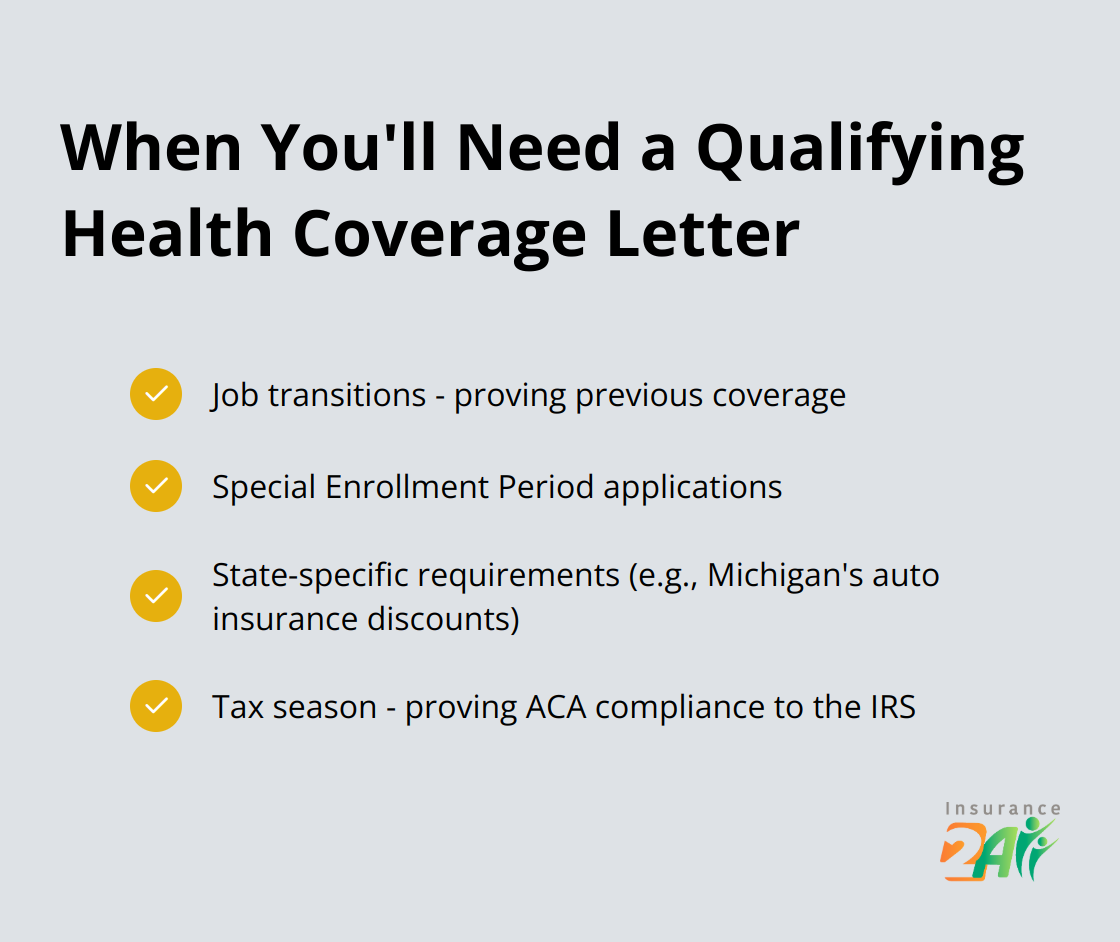

Surprise! You might be flashing this letter more than you’d think. Real-life situations call for it – often:

- Job transitions (yup, gotta show you had coverage)

- Special Enrollment Period super-jump applications

- State shenanigans (think Michigan’s auto insurance discounts…and that’s just one example)

Tax and Legal Implications

The IRS – well, they’re watching. This letter is their signal that you’re playing by the ACA’s rules. No letter? No laugh. They might come at you with penalties when tax season rolls around – and trust me, that’s not where you wanna be.

Obtaining Your Letter

So, you want your Qualifying Health Coverage Letter? It’s not like ordering a pizza, but it’s close (if by close, you mean, 5-7 business days). The drill? Hit up your insurance provider. They’ve got the script, you’ve got the lines, everybody plays their part.

Importance of Safekeeping

This letter isn’t just clutter – it’s VIP. It’s about showing you’re a responsible adult who gets their health coverage duties. Keep it close, like your birth certificate or passport. Don’t let it drift to that mysterious place where important documents go when they disappear.

Master the art of snagging your Qualifying Health Coverage Letter and you’re halfway there. Coming up? Navigating the ins and outs like a pro. So, let’s dive into how you can get this done…and done well.

How to Get Your Qualifying Health Coverage Letter

Contact Your Insurance Provider

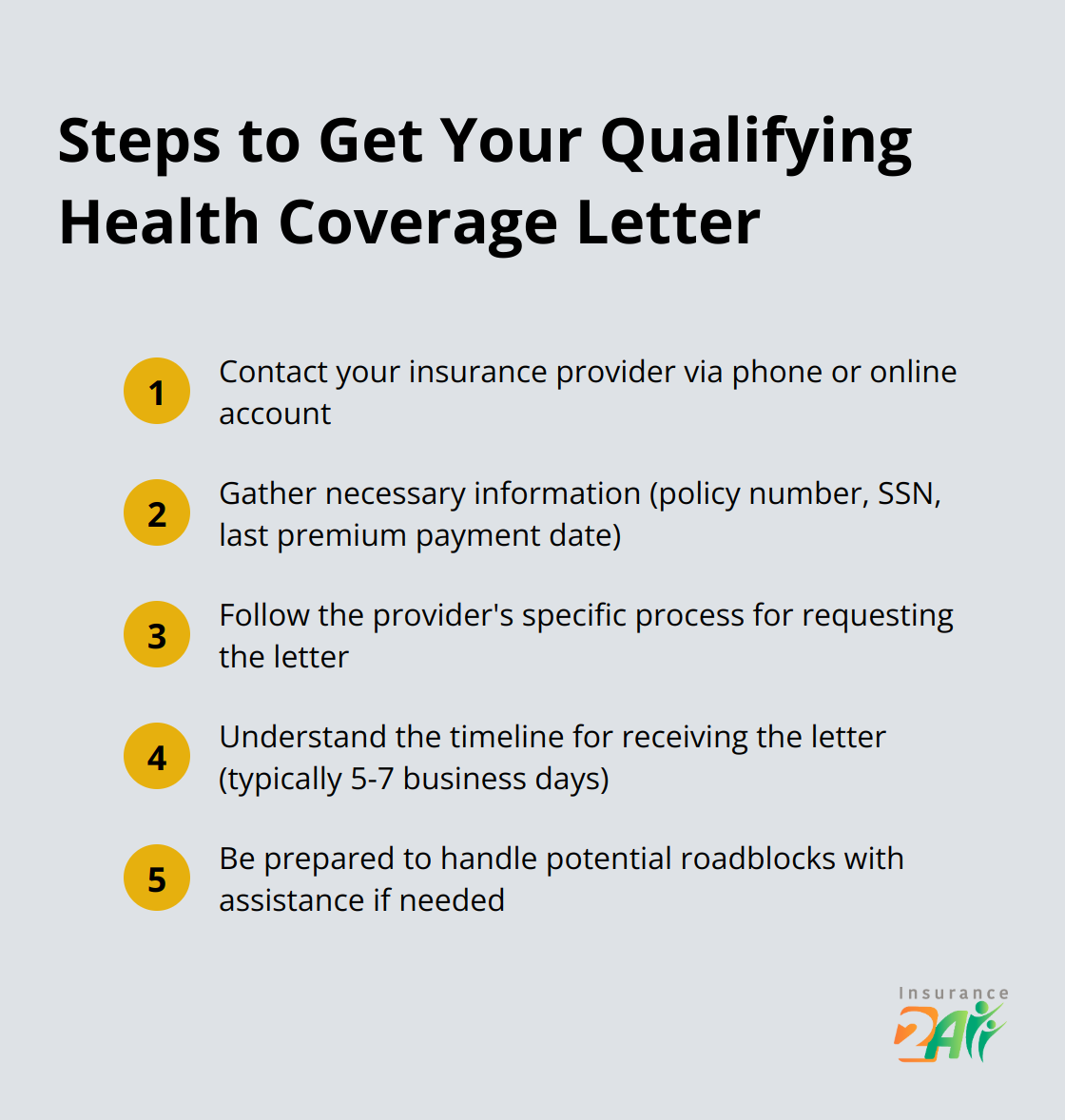

Here’s the deal – get on the phone with your insurance company or jump into your online account. They have the golden ticket (your letter). Don’t waste time wandering off the beaten path – head straight to where the action is.

Gather Necessary Information

Before you hit dial, arm yourself with the essentials. Policy number, social security number, last premium payment date… you get the idea. Having this info at your fingertips can speed things up (and save you from the dreaded “hold on, let me dig that up” faux pas).

Follow the Provider’s Process

Every insurance company marches to the beat of its own drum. Email, portal login, carrier pigeon – it varies. Whatever gets thrown your way, follow their lead to the letter. Deviate and you could be waiting (and who’s got time for that?).

Understand the Timeline

Most places churn out this letter in a snap. But – and it’s a big but – avoid last-minute scrambles. Need it by a certain date? Don’t procrastinate. (Heads up: Switching providers? Snag this letter before you cut ties with the old. Trust me, future you will thank you.)

Handle Potential Roadblocks

Murphy’s Law – sometimes things just don’t go according to plan. If hurdles pop up, keep calm. Your insurance company likely has a team ready to swoop in and assist. Still in a bind? Maybe rope in a savvy insurance advisor for a lifeline.

Your Qualifying Health Coverage Letter isn’t just paper – it’s your passport to coverage and compliance. Don’t let chasing it down turn into chaos. Got obstacles? There’s a cavalry ready to help. Now, let’s decode the common hiccups and smooth the journey.

Navigating Roadblocks in Getting Your Coverage Letter

When Your Insurance Provider Goes Silent

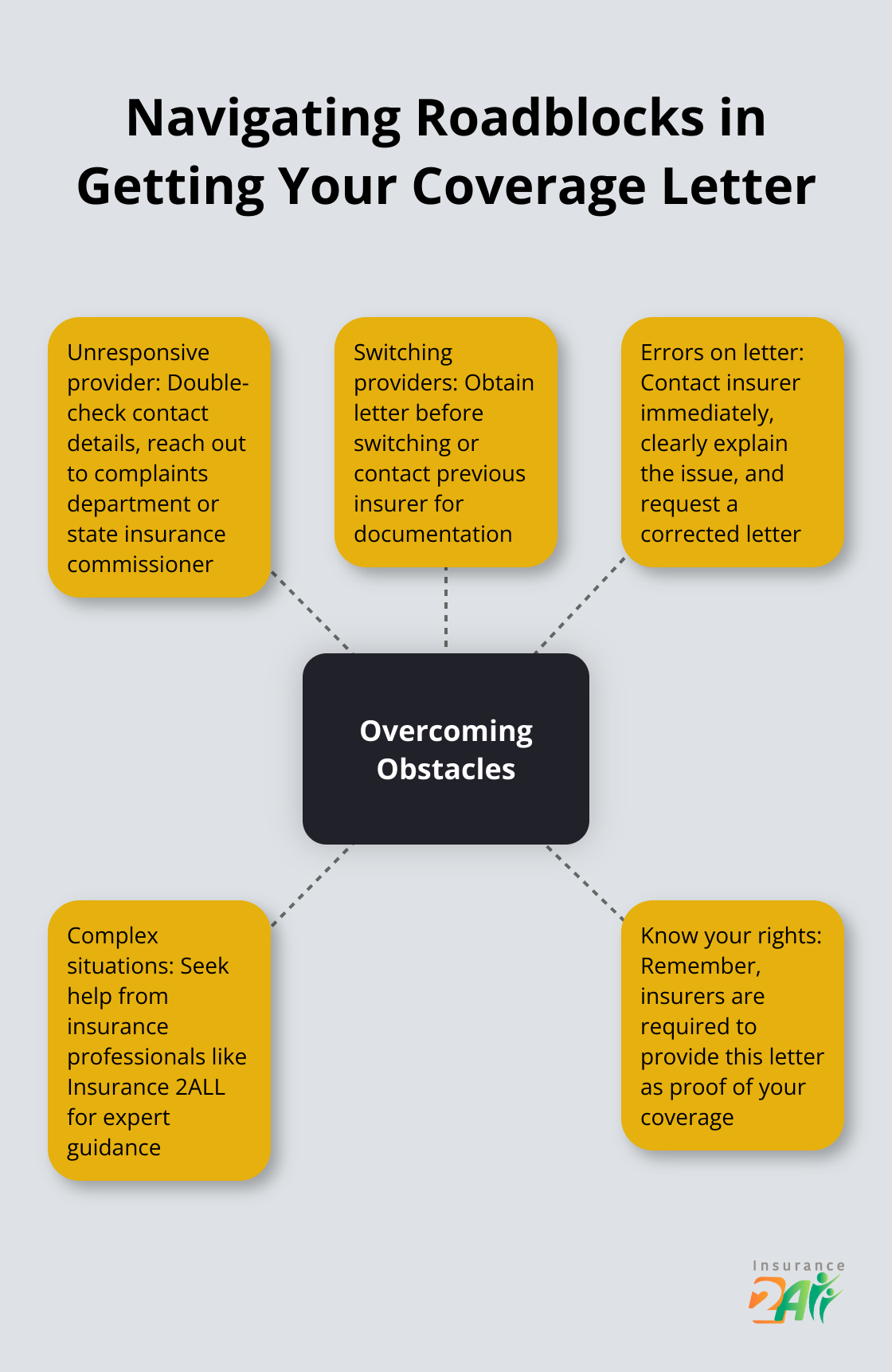

You’ve called, emailed, and, let’s be honest, probably shouted into the void-your insurance provider remains unresponsive. Keep the faith, folks. First, double-check those contact details. Got them right? Then it’s action time. Most insurance firms have a complaints department (or maybe an ombudsman lurking somewhere). Reach out. If that’s a no-go, your state’s insurance commissioner might just be your knight in shining armor.

Switching Providers? Take These Steps

Switching up insurance companies? Oh, the joys. Grab that letter from your previous insurer before the switcheroo. Already made the leap? Stay calm. Ring up your old provider anyway-they’re legally bound to provide the goods. If they stall, your new insurer might have some tricks up their sleeve, channels to spot-check your prior coverage.

Spot and Fix Errors on Your Letter

So, you’ve got your letter, but… something’s funky. Don’t glance over it. Mistakes happen-wrong dates, misspelled names, the works. Spot an error? Get in touch with your insurer pronto. Lay out the issue (clearly, please) and ask for a shiny new letter. Usually, they’ll sort it out. If not, drop your request in writing. Creates a paper trail, folks (which can be your ace if you need to take things up a notch).

Seek Expert Help When Needed

Banging your head against a wall? Call in the cavalry. Insurance professionals (think the pros at Insurance 2ALL) have navigated these waters countless times. They know the insurance company dance and can often smooth those pesky bumps in the road.

Understand Your Rights

Remember, folks, these letters are your right. Insurance companies gotta hand them over. Persistence is key, your Qualifying Health Coverage Letter is your proof of coverage, your defense against penalties, and your golden ticket to certain goodies. Providers are required to file the info each year and the IRS is watching. Don’t let roadblocks trip you up. With a little grit and determination, you’ll have that letter in hand before you know it.

Final Thoughts

A Qualifying Health Coverage Letter – yep, that thing that says you’re playing by the insurance rules. So, stash it like you would your grandmother’s secret cookie recipe. Pro tip: digital backup. Why? Because you want it handy when life throws a curveball. Insurance 2ALL… they get it – the byzantine maze of health coverage. They’ve steered countless folks to the right door for their Qualifying Health Coverage Letters.

The squad’s on standby. Seriously, got questions? They’ve got answers – seven days a week, no less. Affordable, comprehensive health insurance that’s just right for you… that’s the goal. And look, it goes beyond snagging a few letters. It’s about cutting through the fog of health coverage, making it accessible for you, me, everyone.

Don’t let insurance mumbo jumbo trip you up. Visit Insurance 2ALL for a friendly nudge in the right direction with your Qualifying Health Coverage Letter – and all your health insurance headaches. They’re all about the custom fit – health coverage that matches your unique groove.