Being your own boss—there’s no HR to call when you’ve got a question about health insurance (those chats, frankly, you won’t miss). But navigating the health insurance maze? That’s a different ballgame. At Insurance 2ALL, we get it—protecting your health while you’re juggling all the hats of your own biz is crucial.

Consider this your roadmap to cutting through the clutter. We’ll break down the myriad of options (it’s like a menu, but less tasty) so you can actually make a smart choice about your health insurance needs.

What Health Insurance Options Do Self-Employed Individuals Have?

Ah, the life of a self-employed individual-freedom, flexibility…and figuring out your own health insurance. Let’s dive into your options, because navigating this maze is crucial for your wallet and your well-being.

Marketplace Plans Under the Affordable Care Act

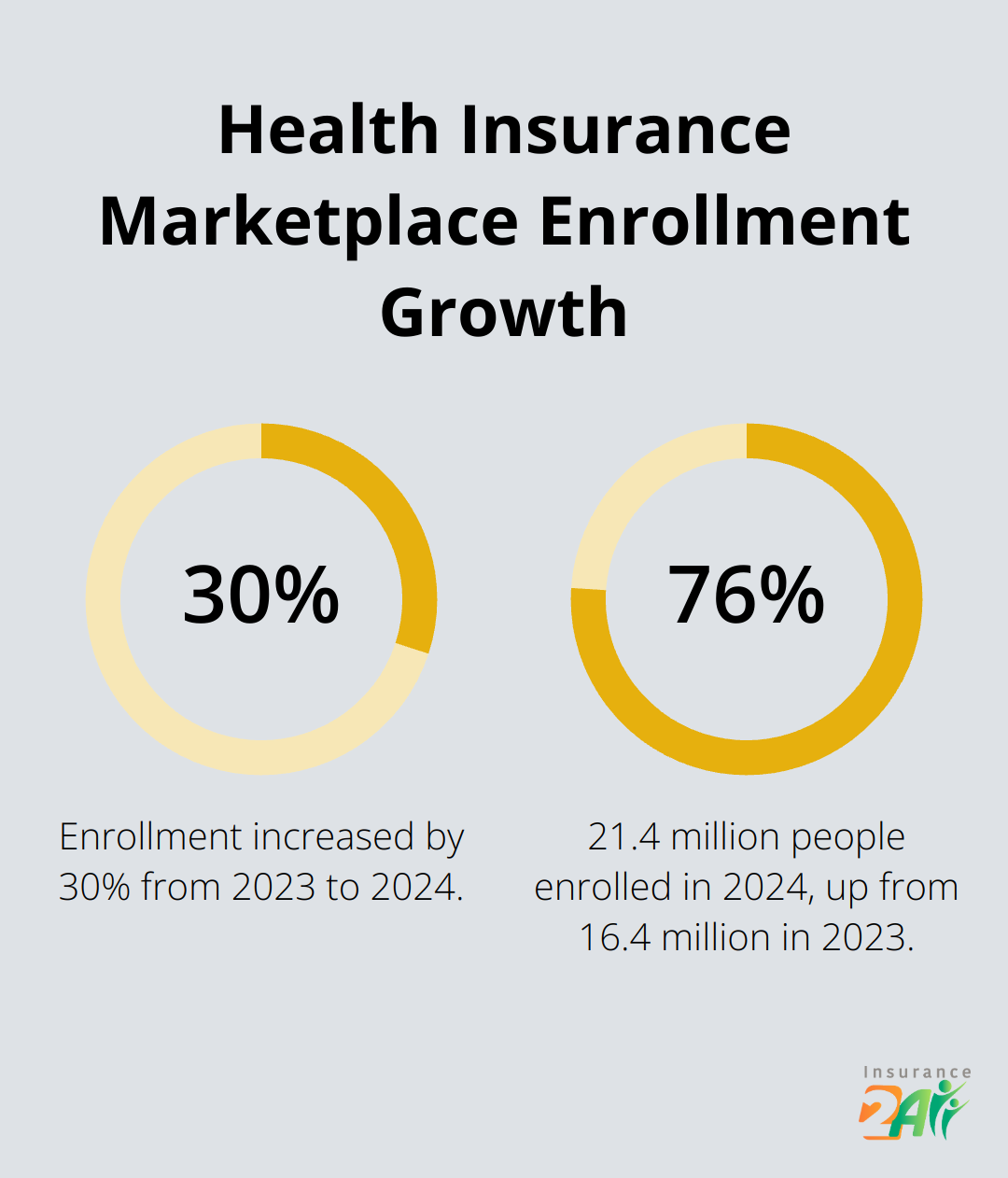

Step into the Health Insurance Marketplace, your go-to for a buffet of health insurance plans tailored for the self-employed. We’re talking comprehensive coverage (yes, pre-existing conditions are a non-issue here) and a growing number of folks signing up-jumping from 16.4 million in 2023 to 21.4 million in 2024.

The cherry on top? Financial assistance. Crunch the numbers on your income and you might find yourself basking in premium tax credits or cost-sharing reductions. Nice.

Short-Term Health Insurance Plans

Need something just to tide you over? Short-term health insurance plans got you. They’re cheaper-lower premiums-but don’t get too comfy. They’re not as thorough as their ACA counterparts. These serve up a temporary stay, from a few months up to a year (with some states cutting you a deal for renewal).

But a heads-up-short-term means they don’t have to play by ACA rules. Denials on pre-existing conditions? Possible. Missing some essential health perks, like those prescription drugs or mental health services? Likely.

Health Savings Account (HSA) Compatible Plans

Want the taxman to give you a high-five? Look no further than an HSA-compatible plan. Think high-deductible magic that lets you stash away pre-tax dollars into a Health Savings Account.

What’s the deal with contributions? Well, they depend on your HDHP coverage (self-only or family) the first day of the last month of your tax year. Tax-deductible, tax-free growth, tax-free withdrawals for qualified expenses-need we say more?

Professional Association Group Plans

Cue the entrance of professional associations-your ticket to potential group health insurance plans. Sometimes, they dish out more affordable rates than hunting down an individual plan solo. Check if your professional tribe offers health benefits, or maybe consider joining one that does.

Now, the balancing act of pros and cons begins. Your mission, should you choose to accept it, depends on what ticks your health boxes, your budget mindset, and where you’re heading long-term. Up next-dishing on the key factors for picking a health insurance plan as a solo flyer.

What Factors Matter Most When Choosing Health Insurance?

So, you’re self-employed and diving into the murky waters of health insurance. Think it’s just about snagging the cheapest plan? Think again. It’s a game of chess, not checkers. You want coverage that plays nice with both your body and wallet. Let’s break down the big stuff you need to consider.

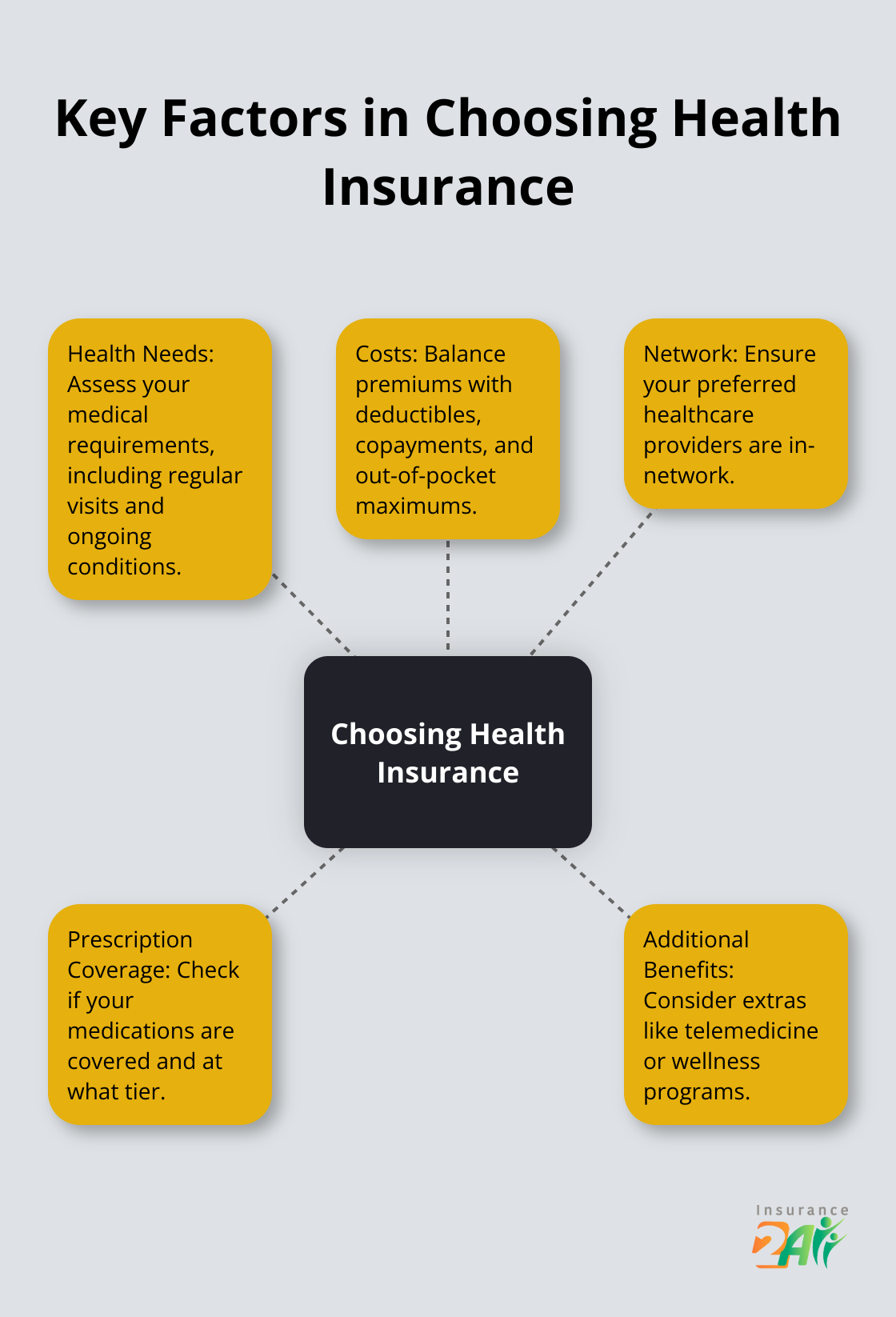

Prioritize Your Health Needs

Start with-you guessed it-the big question: What do you actually need? Regular doctor’s visits? Prescriptions piling up like unread emails? Family planning in your future? Your situation sets the course. Got a chronic condition? Maybe aim for a lower copay on specialist visits, even if it means coughing up more on premiums.

Balance Costs Effectively

Yep, the budget’s a beast. But don’t get hypnotized by that monthly premium number alone. Think big picture-deductibles, copayments, and the terrifying out-of-pocket max. A dirt-cheap plan with a sky-high deductible is like buying a used car that needs a new engine.

The big brains at the Kaiser Family Foundation told us that in 2022, the average single coverage premium hit $7,911 (family coverage, a jaw-dropping $22,463). Keep these nuggets in mind when playing eeny, meeny, miny, moe with your options.

Evaluate Your Doctor Network

You love your doc, right? Make sure they’re in the network of any plan you’re eyeing. Going out-of-network can drain your bank account faster than you can say “deductible.” Some options, like certain HMOs, laugh in the face of out-of-network coverage (unless, you know, it’s a life-or-death situation).

Consider Prescription Drug Coverage

Got a medicine cabinet that’s starting to look like a pharmacy? Dig into the prescription drug coverage of your potential plans. Each plan’s got a formulary-a fancy word for a covered drugs list. Check that your meds are on it-and note what tier they’re on because higher tier equals higher copay.

People have kept their piggy banks fuller by finding plans that give them a break on their specific meds. It’s not wasted time; it’s money in your pocket.

Weigh Additional Benefits

Telemedicine, wellness programs, gym discounts-oh my! Some plans throw in extra goodies aligned with your lifestyle. Not the main event, but if you’re torn between two plans, these little bonuses might just be the tie-breaker.

The perfect health insurance? It’s a balancing act, weighing all these factors. Tracking down the right coverage might feel like a slog, but peace of mind is worth its weight in gold. If you’re spinning out trying to make sense of it, don’t be shy about getting advice from the pros. Onward to locking down your ideal plan as a self-employed go-getter.

How to Get Health Insurance When You’re Self-Employed

Assess Your Health and Financial Situation

Kicking off your self-employment health insurance quest calls for, you guessed it, a hard look at your health and wallet – two critters that don’t always play nice together. Jot down those pesky ongoing medical issues, the meds you pop like candy, and your frequency of doc visits. This handy checklist will tell you exactly how much (or little) coverage you’ll need.

Now, onto the dollar game: take a magnifying glass to your budget, squeezing in those health insurance premiums and, oh, don’t skip those sneaky out-of-pocket wonders – deductibles and copays need love too.

Explore Available Options

Armed with clarity on needs and budget – time to dive into your options pool. The Health Insurance Marketplace (a favorite playground for the self-employed, by the way) is where the adventure begins. In 2024, more than 21.4 million consumers either joined the ‘family’ or hit replay on their plans… proof it’s a hit.

And hey, check out professional groups in your area – they might just offer group health plans that could beat those solo rides you’ve been eyeing. The Freelancers Union has your back, opening doors to health insurance options for those flying solo.

Compare Plans Carefully

You’ve narrowed down the contenders – now it’s time for the beauty pageant. Look beyond the glitter of monthly premiums:

- Deductibles: That’s the chunk you cough up before the insurers swoop in.

- Copays and coinsurance: Yeah, the cash chunks you shell out for doctor chit-chats and treatments.

- Network: Make sure your cherished healthcare pros haven’t ghosted from the network list.

- Prescription coverage: Fact-check if your meds are a match and their price tag.

Your state insurance department has a slew of comparison tools to make life a tad easier.

Apply at the Right Time

Timing, kiddo, is your ally here. The annual Open Enrollment Period’s your window – from November 1 to January 15. Jot that on your fridge… or face the wrath of missing out.

Qualified life event survivor? Lost coverage, tied the knot, or baby on board? You might get a Special Enrollment Period pass – a 60-day exclusive membership outside the standard slot.

Prepare Documentation and Submit Your Application

With armor on and plans in sight, start gathering your collectibles:

- Proof of income (tax returns, 1099s, profit/loss scores)

- Proof of citizenship or legal presence

- Social Security numbers for you and the crew

- Intel on any existing health coverage

Applications can be a breeze online, but if you’re craving human interaction – phone and face-to-face options are there to hold your hand.

Lost in the maze? Insurance 2ALL is at your service, delivering personalized help 24/7 to nab that coverage that’s as unique as your freelance gig. Check out options that dance well with your budget and quirks – hassle-free.

Final Thoughts

So, self-employed folks and health insurance – the plot thickens. You’re navigating a jungle of options here: Marketplace plans, short-term this and that, HSA-friendly choices, and even some professional association group thingamajigs. It’s like choosing toppings at a frozen yogurt bar. The deal is, dive in and really assess (some will say over-analyze) – your health needs, your bank account, and where you want to be in five years… no crystal ball here, just a smart way to future-proof yourself.

Get this wrong, and one nasty health hiccup can wipe out dreams – personal and professional. Correct insurance? It’s not just about health; it’s the backbone of your business longevity. Essentially, you need a plan you can bet on for well-being – and the sanity of your financials.

Over at Insurance 2ALL, we’re on it. We get the maze that is self-employed insurance. Our team? Fanatical about crafting solutions that speak your language and your wallet. Reach out – let’s get a safety net sorted, so you’re free to turbocharge your business without reading the fine print every night.