Finding comprehensive health coverage can feel like deciphering hieroglyphics. So many options, terms that make your head spin… it’s a quagmire of confusion.

Enter Insurance 2ALL. We get it. This is a labyrinth, and you’re searching for the thread to guide you through. That’s where our guide steps in—like a map in the madness—to help you weave through the world of health insurance and find what fits you (and your wallet) best.

What Are the Basics of Health Insurance?

Health insurance – it’s like trying to read Ikea instructions but for your health. Let’s untangle the spaghetti… start with deciphering the types of plans you’re gonna bump into.

Health Insurance Plan Types

The big three – HMOs, PPOs, EPOs. Here’s the scoop: HMOs (Health Maintenance Organizations) will save you some bucks but lock you down to a network, kind of like an exclusive club – you ain’t getting in without an invite. PPOs (Preferred Provider Organizations) give you the keys to flexibility at a cost that makes your wallet weep a bit more. EPOs (Exclusive Provider Organizations)? Somewhere in the Goldilocks zone.

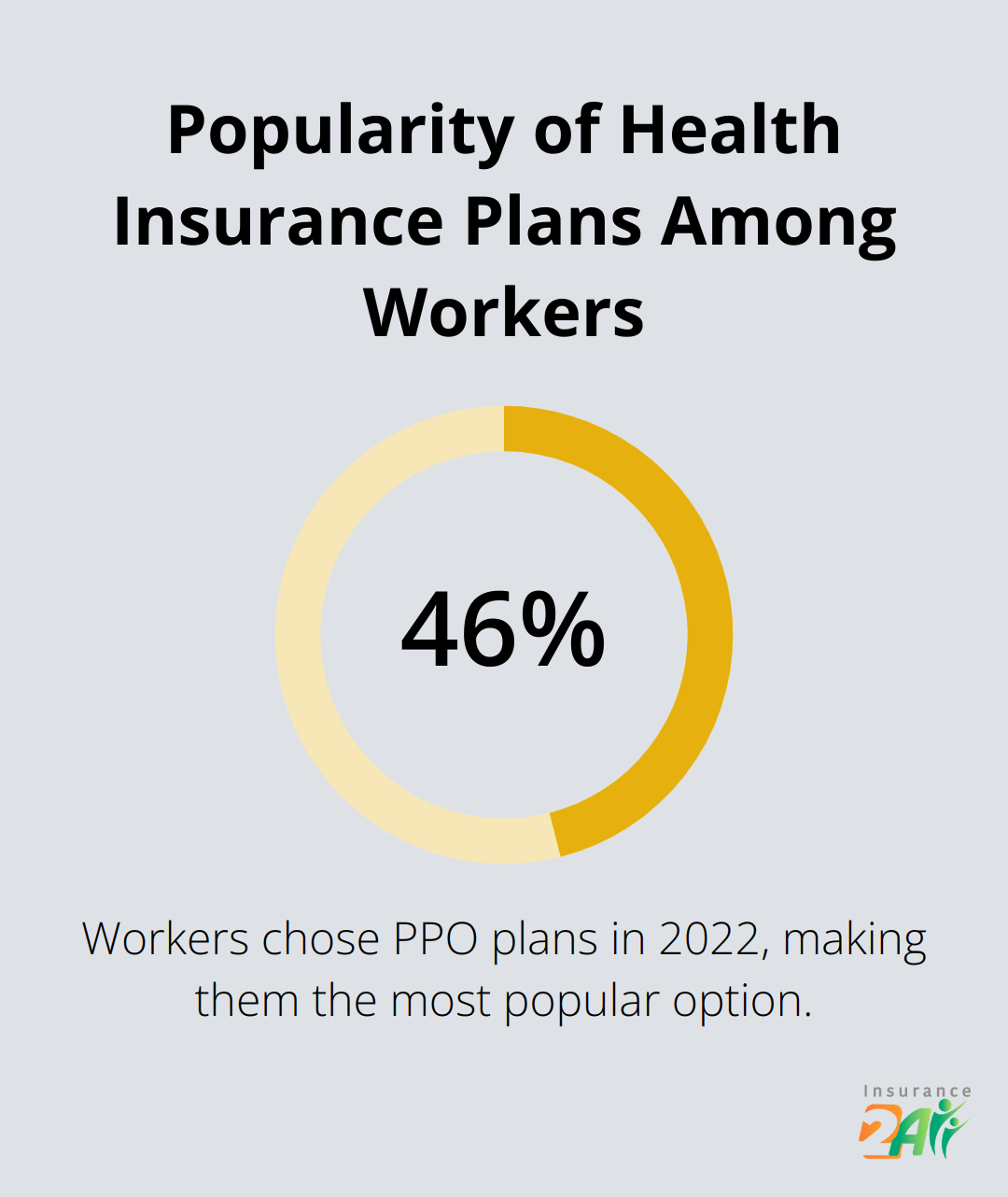

According to the Kaiser Family Foundation, 46% of workers in 2022 played it safe with PPOs. Most popular kid on the block.

Key Terms You Need to Know

Let’s break down the jargon:

Premiums: Basically, your monthly subscription to health insurance drama.

Deductibles: The cash you throw down before your insurance decides to grace you with its presence. So, if it’s $1,000… you’re the one making it rain those first dollars.

Copayments: The small tribute you pay for a visit – kind of like saying thanks to the doc with a $25 gesture.

And per the Kaiser Family Foundation, the 2022 classic deductible for singles hovered around $1,763.

Essential Health Benefits

Here’s where the ACA – the Affordable Care Act – steps in with a top-ten list (no, not music). Your health plan must cover these:

- Outpatient care

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services and devices

- Laboratory services

- Preventive and wellness services

- Pediatric services (including oral and vision care)

These are must-haves, so you’re not left in the lurch.

How to Apply These Basics

So, what’s next? Understand these basics, and you can navigate the ins-and-outs of health insurance like a pro. Compare plans… figure out the dance between HMOs and PPOs or how deductibles shake down what you fork out.

For instance, if specialists are your go-to crew, a PPO might just be your match made in heaven – even if it costs a bit more. Feeling healthy as a horse and want to keep the cash flow? Maybe an HMO is calling your name.

Juggle your budget with your health quirks when sifting through plans. A tempting low premium could be a Trojan horse – surprise! More costly if you’re always at the doc’s.

In coming days, we’ll dive into sizing up your special health coverage needs. Arm yourself with this intel – find a plan that’s a snug fit for your wallet and gives you the coverage cushion you need.

What Are Your Health Coverage Needs?

Assess Your Current Health

Starting with the basics: your health status-it’s the cornerstone of your insurance needs. Got chronic conditions? Pop pills like candy? These little nuggets of health (or lack thereof) shape the type of coverage you’re gonna need. Let’s get real: if you’re managing something like diabetes, a plan with killer prescription drug coverage and regular check-ups is non-negotiable.

Take a gander at the data: the Centers for Disease Control and Prevention says 6 in 10 adults in the US have a chronic disease. It’s a club nobody wants to join, but if you’re in it, your coverage has to be more comprehensive than for someone who only visits their doctor once in a blue moon.

Anticipate Future Health Needs

Future’s a tricky beast-can’t predict it, but sure can plan for it. Thinking about starting a family? Considering a big-ticket surgery? These life events will absolutely shake up your healthcare needs (and empty your wallet faster than you can say “deductible”).

According to the American Society for Reproductive Medicine, 1 in 8 couples hits the infertility obstacle. Family planning wisdom: if it’s on your horizon, zero in on plans that have your back with fertility treatments. Check out this nugget on family planning.

Evaluate Your Budget

Let’s talk money-your budget is the unsung hero (or villain) of the insurance saga. The National Health Interview Survey spilled the beans: in 2022, 8.4% of people pushed off medical care because of costs. Let’s avoid that train wreck, shall we?

Crunch those numbers-income, savings, regular expenses. Figure out what you can shell out monthly for premiums. Pro tax tip: lower premiums usually mean you’re forking out more when care time rolls around.

Consider Your Preferred Providers

Doctors and hospitals-yep, they matter. Are they chilling in-network with the plans on your radar? Heads up: The Health Care Cost Institute warns that out-of-network care can scream “cha-ching” up to 5 times louder than in-network care.

Got a specialist you absolutely can’t live without? Make sure they’re in your new plan. (Pro tip: Insurance 2ALL can suss out plans that include your healthcare favorites.)

Explore Plan Types

Plan types-one size does not fit all, folks. Health Maintenance Organizations (HMOs) cut costs but confine you to a network. Preferred Provider Organizations (PPOs)? They’ll give you freedom, at a price. Exclusive Provider Organizations (EPOs) sit somewhere in between.

Fun fact from the Kaiser Family Foundation: in 2022, 46% of workers picked PPOs-these folks are fans of flexibility. But hey, remember this: the best plan is the one that fits your unique situation.

As you dive into the wild world of health coverage, keep these nuggets in mind. When you’re ready to take things up a notch, eyeball the insurance smorgasbord-employer plans, individual marketplace options, and some government goodness. Welcome to the health coverage party.

Where Can You Find Health Insurance?

Employer-Sponsored Plans: The Go-To Option

Let’s face it – for most Americans, employer-sponsored health insurance is the golden ticket. In 2023, a whopping 94% of companies with 50+ employees are dishing out health benefits like hotcakes. Why? Because they’re typically cheaper and more inclusive than going solo. So, if you’re lucky enough to have a job, hit up your HR department. They’re the gatekeepers to your health coverage details, costs, enrollment timelines – the works. But hey, don’t sleepwalk through renewal each year. Life changes. So do your needs and the plans themselves. Make it a habit to do a yearly check-up on your coverage.

Marketplace Plans: Your DIY Insurance Shop

No workplace safety net? Fear not. You’ve got the Health Insurance Marketplace. It’s like the Amazon of insurance – browse at Healthcare.gov or your state’s marketplace when open enrollment rolls around (think November, December). And hey, you may score some subsidies based on income. Do the homework; don’t leave dollars on the table, folks.

Government Programs: Uncle Sam’s Coverage Options

If you’ve hit the big six-five, have a disability, or live on a tighter budget, government programs have got your back. Medicare is the go-to for the 65+ crowd and folks with certain disabilities. It’s got the whole alphabet soup of parts – A, B, C, D – each covering different stuff. Dive into Medicare before the clock strikes 65. Knowledge is power. Then there’s Medicaid and CHIP, the lifelines for low-income individuals and kids. Since eligibility is a state-by-state affair, eyeball your local guidelines.

Professional Assistance: Navigating Your Options

Lost in the insurance jungle? Consider bringing in the pros (think Insurance 2ALL). These folks can be your compass in the wild, helping you choose the right plan, whether it’s via your job, the marketplace, or good ol’ Uncle Sam.

Comparing Plans: Making an Informed Decision

When you’re sifting through the insurance buffet, keep an eye on a few must-haves:

- Monthly premiums

- Deductibles and out-of-pocket ceilings

- Coverage for your go-to doctors and hospitals

- Coverage for those all-important meds

- Extra perks (like dental, vision)

It’s a balancing act, people. Don’t be lured by low premiums – they could hit your wallet hard if that doctor’s office is your second home.

Final Thoughts

So, you’re on the quest for health coverage? Buckle up-this isn’t a quick drive through the countryside. You need to wrap your arms around plan types, what those pesky jargon terms mean, and-drumroll please-what you personally need. Your health status, future what’s-nexts, and your wallet’s comfort level are the key pieces of this puzzle, all while keeping your favorite healthcare artists (doctors) in the loop. You’ve got the employer-sponsored plans, the Health Insurance Marketplace, and trusty old pals like Medicare and Medicaid-all competing for your attention.

News flash: Your insurance needs are not set in stone. They’re more like water-constantly in motion. Job changes? Baby on the way? Suddenly discovering a new ‘quirk’ in your health? All these life events are like wild cards that demand a review, a check-in, to make sure your policy is keeping up. Staying clued-in means you’ll keep that precious veneer of protection-because who wants to be caught without an umbrella in a downpour?

Enter Insurance 2ALL – your trusty guide through the gnarly forest of health insurance. They’re the Yoda to your Skywalker, helping you find that elusive plan that suits your life and your bank account (no hidden fees!). These folks offer the lowdown on Obamacare and Medicare plans, opening their door seven days a week to help you untangle all those knots of questions and concerns.