Getting the axe — yeah, it’s a real downer, and trying to figure out how to keep your health insurance while job surfing? Headache city. But here’s the deal: At Insurance 2ALL, we’ve got your back when you’re in transition mode.

Today’s topic? Navigating the shark-infested waters of health insurance while you’re between gigs. We’re here to map out your options for staying insured (without pulling your hair out). Plus, we’ll walk you through the whole circus act of finding coverage and help you pin down what fits like a glove for your unique situation.

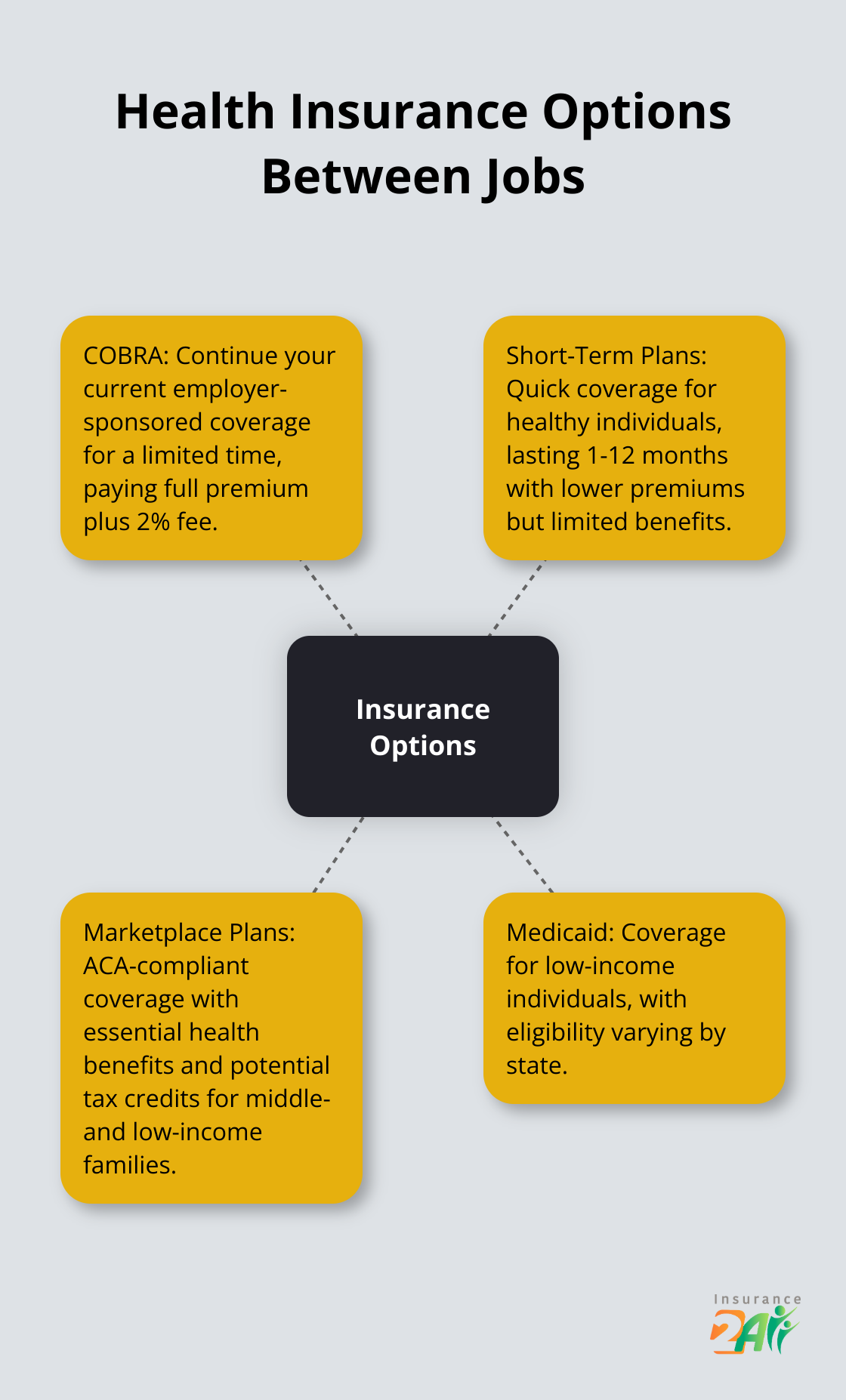

What Are Your Health Insurance Options Between Jobs?

Losing your job doesn’t mean you have to lose your health coverage. Let’s break down your choices so you can make an informed decision.

COBRA: Keeping Your Current Coverage

COBRA generally requires that group health plans sponsored by employers with 20 or more employees in the prior year offer employees and their families the opportunity to continue their health coverage for a limited time after certain events, such as job loss. It’s a familiar option, but it comes with a catch – you’ll pay the full premium plus a 2% administrative fee.

Short-Term Plans: Quick Fix for Healthy Individuals

If you’re generally healthy and need coverage for a brief period, short-term health insurance might be your ticket. These plans typically last from one to twelve months and often have lower premiums. However, they don’t cover pre-existing conditions and may have high deductibles.

Marketplace Plans: Comprehensive Coverage with Potential Savings

The Health Insurance Marketplace allows individuals and small businesses to compare health plans on a level playing field. Middle- and low-income families can get tax credits that lower costs. These plans comply with the Affordable Care Act (ACA), cover essential health benefits, and can’t deny you for pre-existing conditions.

Medicaid: Coverage for Low-Income Individuals

If your income has significantly decreased, you might be eligible for Medicaid. Eligibility varies by state, but in states that expanded Medicaid under the ACA, you may qualify if your income is below 138% of the federal poverty level.

Navigating Your Options

While these options provide a safety net, finding the right fit can feel overwhelming. Insurance 2ALL offers expert guidance to help you navigate these choices, ensuring you get the coverage you need without breaking the bank. Our team can provide personalized support to help you understand the pros and cons of each option and how they align with your specific needs.

As you weigh your options, consider factors such as your health status, upcoming medical needs, and budget constraints. Don’t let a job transition leave you uninsured – take action to secure the right coverage for your situation. In the next section, we’ll explore how to evaluate your health insurance needs to make the best choice for your circumstances.

What Should You Consider When Choosing Health Insurance?

Assess Your Current Health Status

Let’s chat about your health-it’s kind of a big deal when picking the right insurance. Are you dealing with anything ongoing, like diabetes or a heart condition? Because if you are, that’s gonna shape your choices. If you’re the picture of health, a high-deductible plan might do the trick-pay a bit less now, worry later. But if the doc’s office is your second home, maybe go for lower copays. No rocket science here, folks.

Anticipate Future Health Needs

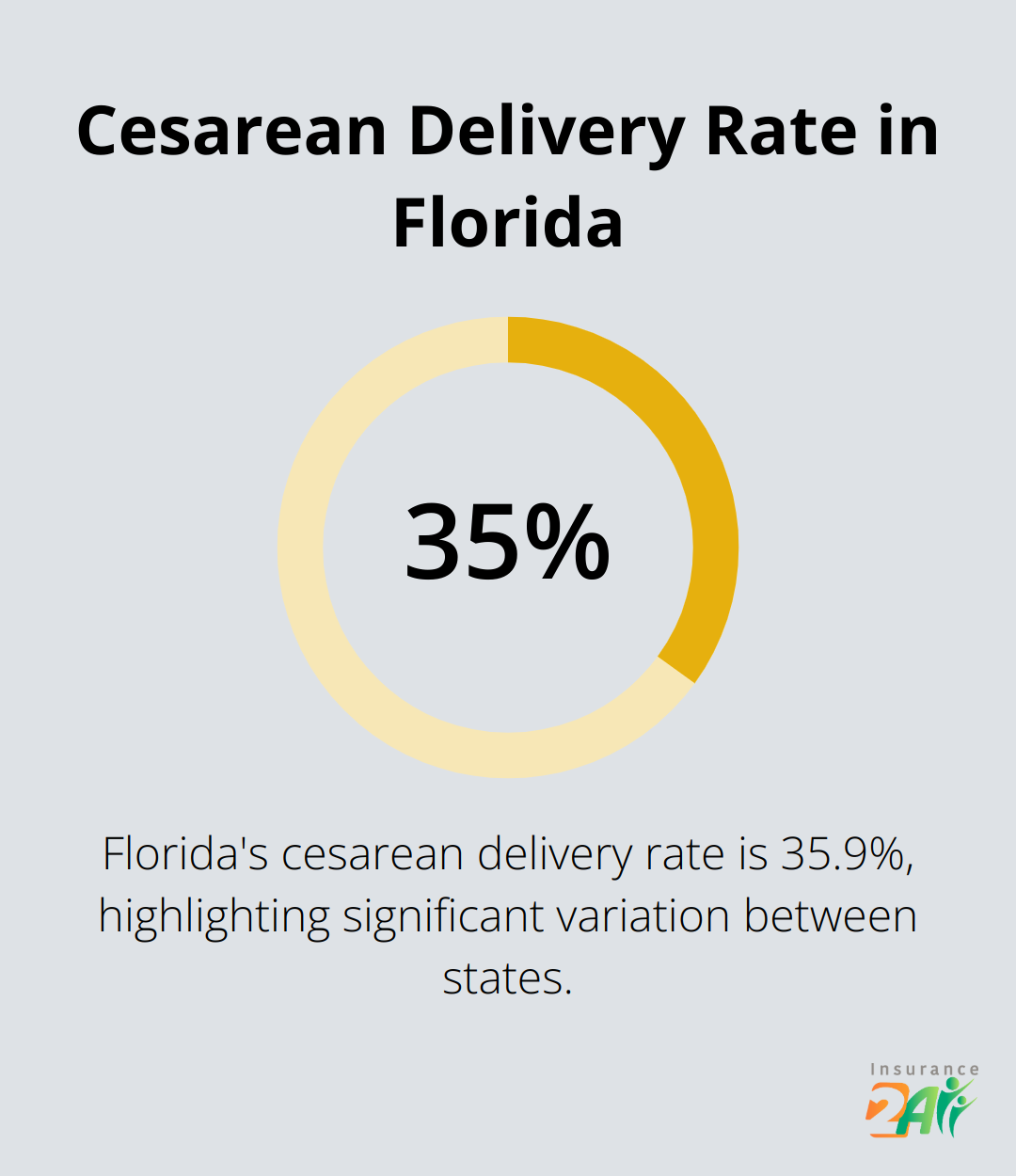

Gaze into that crystal ball-do you see surgeries? Little ones crawling around soon? These things can steamroll your wallet. For instance, cesarean delivery rates do a little jig from state to state, with Florida hitting 35.9%. Yeah, gulp. You’ll want a plan that’s ready for these expenses before they sneak up on you.

Consider Prescription Medication Costs

Rx prices-they add up faster than you can say “pharmacist.” There was a jump of 7.4 percent for single source drugs from January 2022 to January 2023-ouch. If your medicine cabinet’s brimming, check those plans. Some treat brand-names like royalty, others are all about the generics. Get cozy with that formulary (fancy way to say “list of covered drugs”)-your bank account will thank you.

Analyze the Financial Aspects

Ah, the money part. Premiums, sure, but there’s more to it-deductibles, copayments, out-of-pocket max. A plan with a sweet, low premium? Sounds tempting. But if it comes with a $10,000 deductible? Yeah … hope you’re not planning on any expensive accidents.

Balance Coverage and Affordability

Striking the balance-it’s like juggling flaming swords. Don’t fork over cash for stuff you don’t need … but don’t skimp, leaving yourself exposed if things go south. A little thought, some elbow grease, and you can find that plan-a stress-buster, without hemorrhaging funds.

Now, as you mull this over, get ready to make moves to lock in that insurance. It’s time to dive into the nitty-gritty, ensuring you stay covered while switching jobs. Stay sharp!

How to Secure Health Insurance Between Jobs

Know Your Current Coverage End Date

First things first – know when the clock runs out on your current health coverage. For most folks, it’s the last day of the month when you exit your gig. So, if you call it quits on June 15, your health shield likely holds ’til June 30. And seriously, plant a flag on that date in your calendar. It’s your drop-dead date for locking in the next safety net.

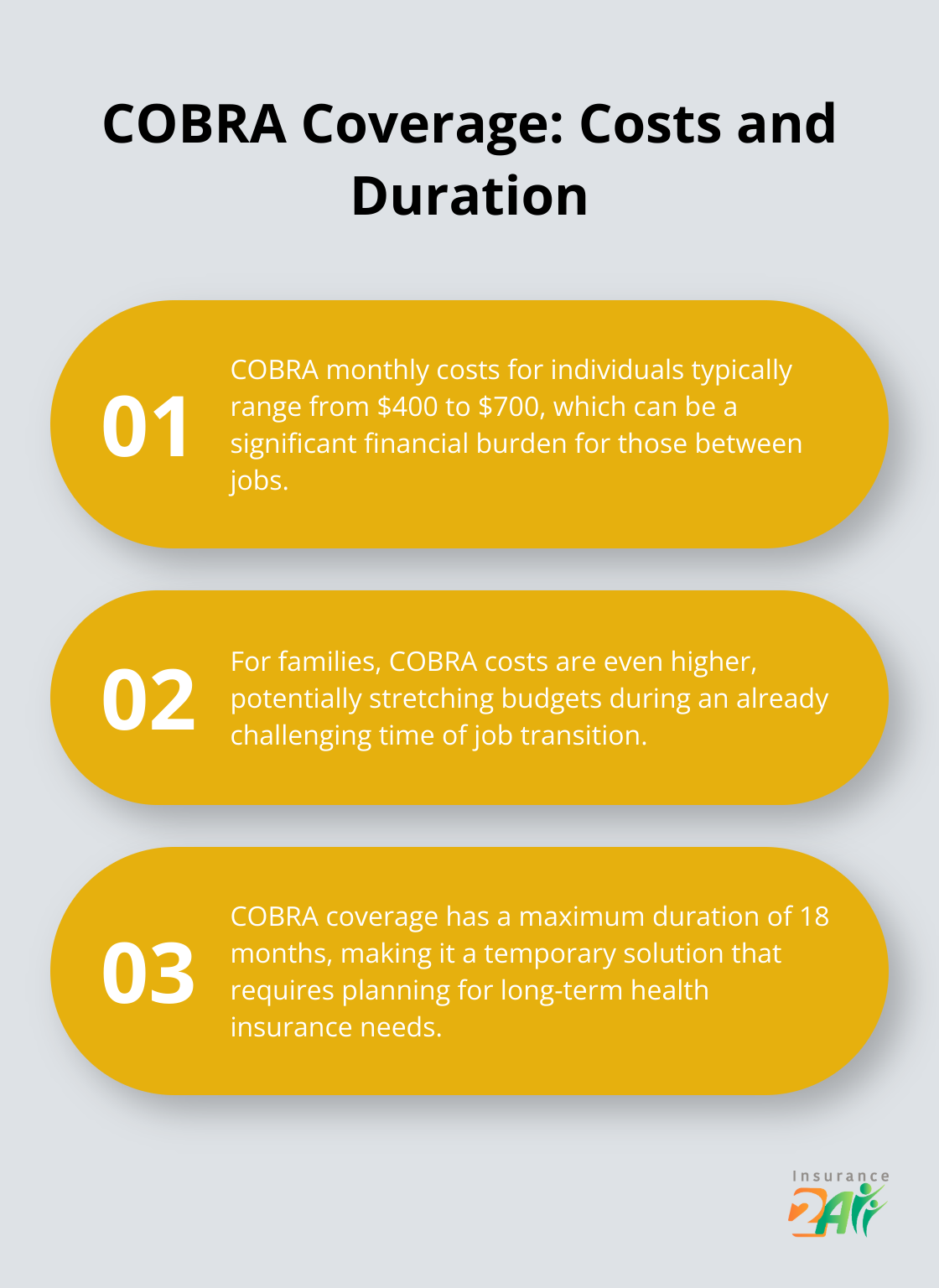

Compare Your Options

Time to talk dollars and sense. COBRA might look like the smooth path to stay insured, but it’s usually a wallet-drainer. Think $400 to $700 a month for a single, and families? Way more. Plus, it’s a short track – 18 months tops. So, you’re really playing chess here to find a lasting move.

Curious about saving some cash? Marketplace plans could lighten the load if you’re subsidy-friendly. Quick tip: If your household dipped into Marketplace coverage for at least a month, a Premium Tax Credit might have your back.

Now, those short-term plans… tempting with their low premiums, right? But beware the fine print. Limits on benefits – often $250k or less – and they skip out on a lot of essential health perks.

Apply for Your Chosen Coverage

Select your plan? Great, now hustle. With COBRA, it’s a 60-day sprint from the moment you get the COBRA election letter to dive in. Miss this, and well, that’s a missed bus.

Marketplace plans serve up a Special Enrollment Period when you lose job-tied coverage. You’ve got a 60-day window either side of losing coverage to jump aboard. Trust me, don’t push this deadline to the brink – coverage generally kicks in the first of the month after you enroll.

Medicaid’s a bit more chill. Apply any time. If you’re in a state with expanded Medicaid and your income sits below 138% of the federal poverty level, you might just score a win.

Avoid Coverage Gaps

Don’t let breaks in coverage sneak up on you. They could sucker-punch you with unexpected bills and, in some states, tax penalties. A neat COBRA trick? Opt in retroactively. You can wait, check in on your health needs, then backdate if you need to.

Switching to a Marketplace plan? Align your enrollment – get that fresh coverage rolling the day after your old one sunsets. Sometimes that means jumping in before the job wrap-up to keep the transition seamless.

At Insurance 2ALL, we get it – change can mess with your mojo. Our squad’s here to cut through the clutter, stack up those options, and nail down the right protection at the best time. Don’t let a job shake-up leave you in the lurch – hit us up for some no-nonsense, personal help to steer through this maze.

Final Thoughts

Alright, folks, let’s talk job loss-and the scary specter of health insurance (or the lack thereof). Losing your job doesn’t mean you’re thrown to the wolves when it comes to healthcare. We’ve got COBRA (yeah, it’s expensive, but it’s there), some short-term plans, Marketplace options, and even Medicaid. These are lifeboats in a sea of uncertainty-keeping you safe from a health crisis that could torch your financial house and derail the shiny new job hunt.

Feeling lost? Drowning in acronyms and fine print? Enter stage left: Insurance 2ALL. They’re the GPS for your health insurance odyssey. Their seasoned crew delivers the personalized touch, ensuring you unearth the coverage that hits the sweet spot for your personal matrix of needs.

Don’t let the chaos of job transitions catch you without a life vest. Make the smart play-reach out to Insurance 2ALL now. They’ll put your mind at ease, lining up the right health insurance to bridge the gap between gigs. And that means you get to focus on landing that next big thing-without fretting about a surprise medical bill turning everything to ash.