At Insurance 2ALL, we’re noticing it… more and more employers diving headfirst into the pool of self-insured health coverage. Why, you ask? Well, self-insured plans throw a unique spin on the whole healthcare game—like choosing your own adventure in managing employee costs and benefits.

So, let’s break it down… what’s the deal with self-insured health plans? We’ll dig into the good, the bad, and the downright interesting—helping you figure out if this path might just be the right one for your organization. Buckle up, because it’s about to get insightful (and maybe a tad entertaining).

What Are Self-Insured Health Plans?

The Essence of Self-Insurance

Self-insured health plans-what’s the deal? It’s a strategic way to handle employee healthcare. Instead of forking over premiums to insurance companies, employers decide to shoulder the financial risk themselves. What do they get? More control over health benefits, potential cost savings… and maybe a bit more stress (let’s be real).

The Mechanics of Self-Insurance

Here’s how it goes down: Employers set aside funds to take care of employee health claims as they pop up. They usually team up with a third-party administrator (TPA) to sort out the claims and run the day-to-day. The Kaiser Family Foundation tells us that 65% of covered workers hopped onto the self-funded bandwagon in 2023. Yep, people are catching on.

Self-Insured vs. Fully-Insured: A Comparison

What’s the big difference between self-insured and fully-insured plans? It’s all about who takes on the risk. In the fully-insured world, insurance companies handle it-just pay those fixed premiums. But with self-insured plans, the employers step up. And for larger employers, this can mean big savings since they kinda have a grip on what to expect in terms of healthcare needs.

Key Components of Self-Insured Plans

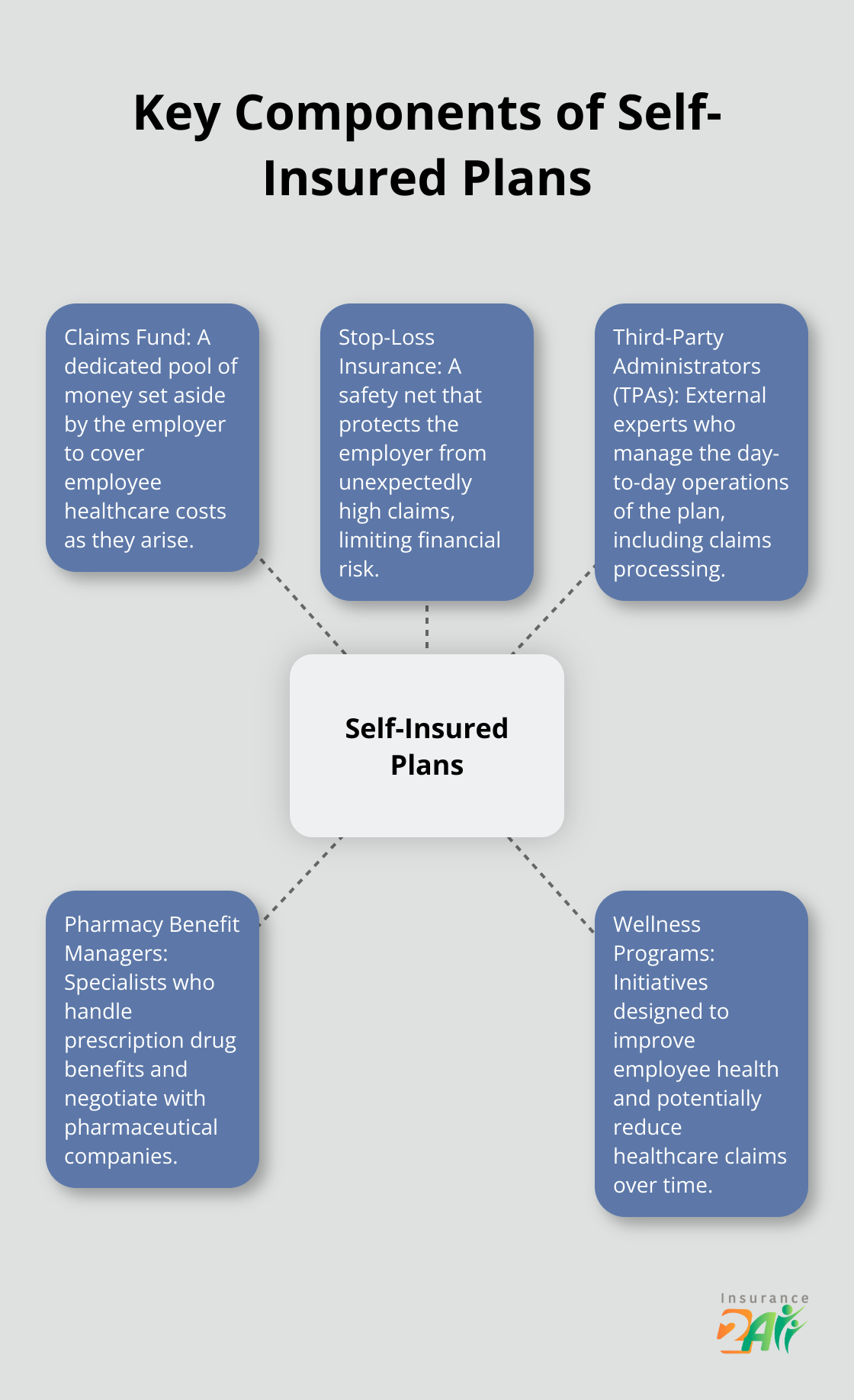

Self-insured plans? There’s a mix of parts making the magic happen:

- Claims Fund: A stash of cash for employee healthcare costs.

- Stop-Loss Insurance: Your safety net for shockingly high claims.

- Third-Party Administrators (TPAs): The masterminds running the plan.

- Pharmacy Benefit Managers: The prescription drug pros.

- Wellness Programs: Efforts to boost employee health and maybe trim down those claims.

Considerations for Implementation

Now, self-insurance? Not for everyone. It’s a decision that starts with some soul-searching on an organization’s size, financial chops, and ability to ride the risk train. Bigger companies seem to vibe well with self-insurance, mainly because they can spread the risk over a larger crowd.

So, what’s next? Dig into the perks of self-insured health plans. Figure out if this way of doing things lines up with your organization’s goals and whether the financial strategy makes dollars (and sense).

Why Self-Insured Health Plans Are Game-Changers

Financial Flexibility and Control

Self-insured plans give employers a level of control over healthcare spending that’s, well, unheard of. Forget those fixed premiums to insurance giants-here, you only shell out for actual claims. This often means big savings (especially when healthcare usage is lower than expected).

Take a dive into a report by the Employee Benefit Research Institute (EBRI) from 2000: around 50 million folks and their families get benefits through self-insured plans. Why? Because cutting out insurance company profits and slashing admin costs can mean dollars back in your pocket.

Tailored Plan Design

Customization is king with self-insured plans. Employers can whip up benefit packages that fit their crew like a glove. Got a tech company full of millennials? Maybe prioritize wellness and mental health. Running a factory? Perhaps focus on occupational health coverage.

It doesn’t stop there. Employers can also bargain directly with healthcare providers-think better rates and premium care for their team.

Data-Driven Decision Making

Data is the new oil, and self-insured plans are sitting on a goldmine. With insights into employees’ healthcare patterns, companies can tweak benefits and roll out wellness programs that hit the mark.

Picture this: high diabetes claims? An employer might launch a diabetes management initiative or team up with a specialist clinic. Bingo-better care and cost savings.

There’s also a case study showcasing how a self-insured benefits team aligned with a national insurer to manage costs without skimping on care.

Regulatory Advantages

Self-insured plans strut with certain regulatory perks. Navigating under federal ERISA laws, they’re often free from state insurance rules-good news for flexibility and cost cutting.

Improved Cash Flow

With self-insured setups, employers hold onto cash that would otherwise fatten insurance companies’ wallets. This boost in cash flow (especially for the big players) means businesses can reinvest or hang onto funds until claim time comes knocking.

Self-insured health plans bring control, flexibility, and insights that traditional plans just can’t touch. But, of course, no system’s perfect. Stick around to dive into the potential pitfalls of self-insured health plans in the next section.

The Hidden Costs of Self-Insured Health Plans

Financial Volatility

Self-insured health plans-welcome to the financial rollercoaster. One minute, you’re saving buckets of cash, the next-bam-a tidal wave of high-cost claims hits you like a ton of bricks. This seesaw routine? Total chaos for your budget.

Stop-loss insurance might be your parachute, but remember, parachutes aren’t free.

Administrative Complexities

Managing a self-insured plan? Think of running your own little insurance company right in your backyard. Employers have to juggle claims processing, provider network management, and jumping through hoops of regulatory compliance.

Most folks kind of miss how much time and energy this monster devours.

Cash Flow Challenges

Self-insured plans can turn your cash flow into a nightmare. Unlike those good old traditional plans with predictable premiums, here you pay claims right when they hit. Boom, expenses skyrocket unexpectedly.

Example: suddenly, lots of employees need major surgeries in the same month-a six-figure bill lands on your desk. Can your business stomach that kind of financial heartburn?

Regulatory Minefield

Tiptoeing through the regulatory jungle of self-insured plans feels like navigating a minefield. Sure, some state rules might take a backseat, but big brothers ERISA, HIPAA, and the ACA? Oh, they’re still in the driver’s seat.

Risk Management Challenges

Jumping into self-insured health plans demands serious planning, a hefty financial cushion, and being okay with hefty risks. Before you dive in, make sure your company’s got the chops to handle these challenges.

Some businesses trip over themselves in the self-insured game-all because they didn’t prep. You better do a full check-up on your organization’s readiness before making the leap to self-insurance land. Health insurance solutions? It’s a wild west out there, and what works for the Smiths could send the Joneses into a tailspin.

Final Thoughts

Self-insured health coverage-it’s like wanting to control your own destiny in employee healthcare. You get a bit of cost savings tangled with some control and flexibility. Sounds good, right? But there’s a catch… the financial risks and admin headaches are no joke. Employers really need to think it through. We’re talking about big decisions here-company size, financial muscle, risk appetite, and who exactly your workforce is.

Before you dive in, you’ve gotta do some serious number crunching. Look at what you’re spending now, what you might save, and what it could cost you. Can your company handle a surprise mega-bill? And what about juggling the admin circus of self-insurance? Call in some experts-trust me, you’ll want a guide through this self-insured maze, especially with all those responsibilities and rules lurking around.

At Insurance 2ALL, we get it-health insurance decisions can feel like a minefield. We’re all over the latest market trends, ready to drop some knowledge bombs on you (whether you’re eyeing self-insured options or just sticking with the good old traditional plans). Check out our affordable, comprehensive health insurance solutions for individuals and families, crafted just for those unique healthcare quirks of yours.